As the scorching summer months near their end, the demand for air conditioning remains steadfast in Italian households. With temperatures consistently high throughout the season, air conditioning has become an essential refuge. Our recent research study has delved into the preferences of Italian consumers concerning air conditioning brands and their underlying purchase motivations. The study’s focal points encompassed the differentiation between brands affiliated with a House of Brands and independent brands, along with the influential role of estate types in consumer decision-making processes.

Purchase Channels: Retailers vs. Online

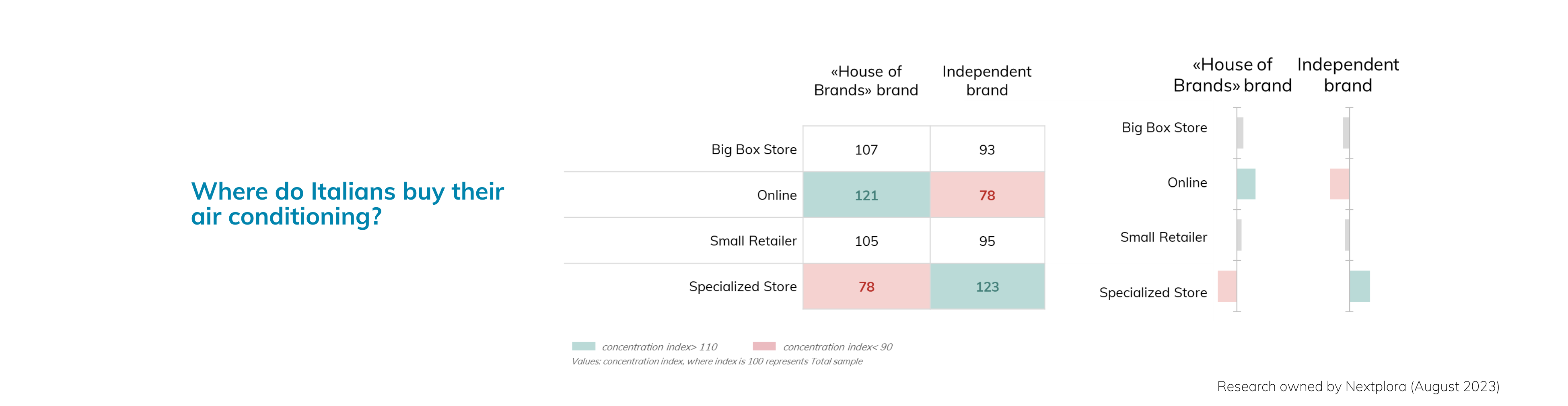

In the midst of this lingering summer heat, the study categorized air conditioning brands into two distinct spheres: those encapsulated within a House of Brands and the realm of independent brands. The statistics revealed a fascinating trend – both types of brands predominantly found their way into consumers’ homes via colossal resellers and retailers (or Big Box Stores), including renowned names like MediaWorld, Euronics, and Unieuro. Surprisingly, the statistics unveiled a formidable 51% preference for House of Brands brands and an equally substantial 45% inclination towards independent brands within these retail emporiums.

In the digital landscape, online avenues constituted a modest fraction, accounting for 13% of House of Brands brand acquisitions and 9% of independent brand acquisitions. Yet, the allure of specialized stores remained undeniable, capturing a considerable slice of the pie with 22% and 35% of House of Brands and independent brand purchases, respectively. A more niche category, small household appliance stores, garnered a modest but significant share, accounting for 13% and 12% of House of Brands and independent brand purchases, respectively.

Concentration Index: Unveiling Distribution Dynamics

Delving deeper, the concentration index illuminated intriguing patterns of distribution. House of Brands brands exhibited a pronounced predilection for online sales channels, while specialized stores registered a more modest concentration. In contrast, independent brands showcased a lower concentration within the digital realm but demonstrated a more substantial presence in smaller, specialized stores.

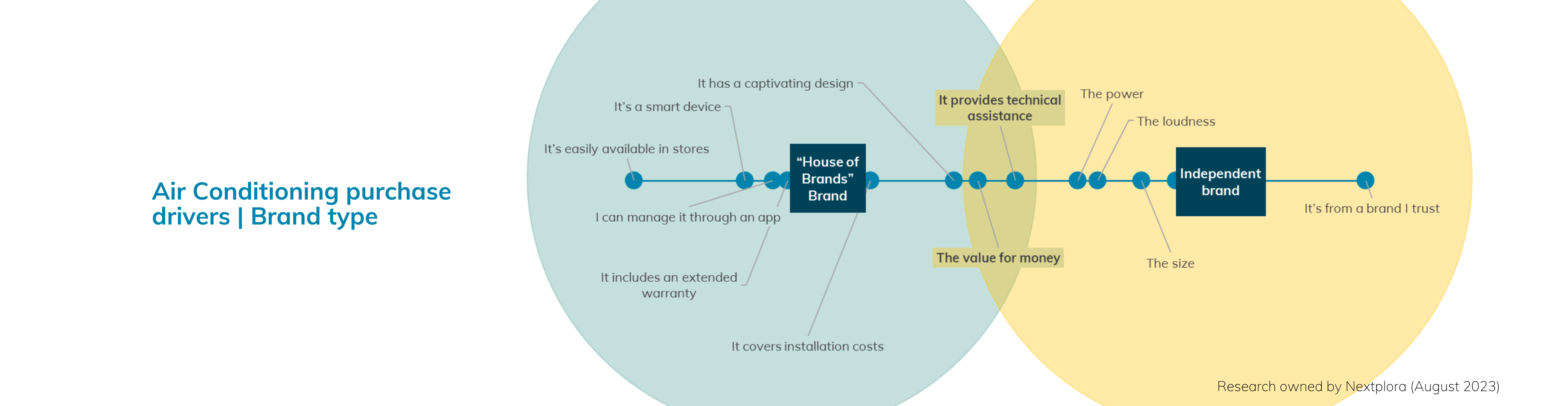

Purchase Drivers Based on Brand Typology

A key facet of the study illuminated the divergent drivers steering consumer preferences when selecting air conditioning units based on the brand’s categorization. Those gravitating towards House of Brands brands placed a premium on variables such as installation costs, extended warranties, the unit’s intelligent features, app compatibility, and its immediate in-store availability. Conversely, consumers opting for independent brands attached significance to size, loudness, power output, and the brand’s reputation for trustworthiness. However, a shared emphasis on technical assistance accessibility and optimal value for money bridged the divide between these two distinct consumer segments.

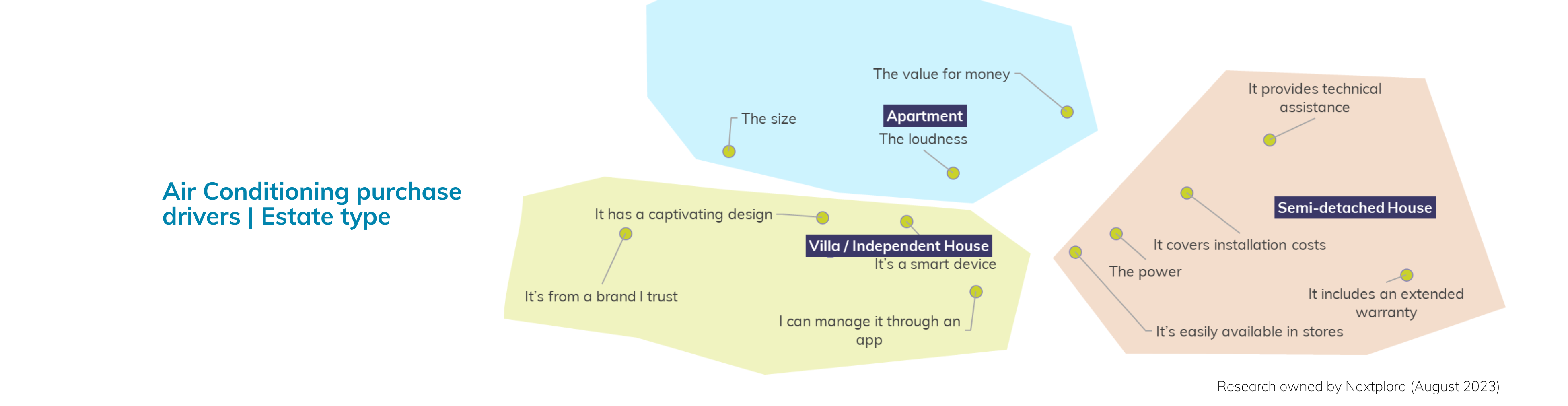

Estate Types: Sculpting Purchase Motivations

Beyond the brand dichotomy, the study’s gaze extended towards the influence of different estate types on purchase determinants. Residents of apartments, notably the urban haven in high-demand cities, exalted size, noise levels, and the paramount factor of value for money. These predilections mirror the realities of apartment living, where spatial constraints and the presence of neighboring dwellers wield significant influence.

In the realm of independent houses and villas, a different narrative unfolds. The emphasis pivots towards aesthetics, integrating “smart” functionalities that allow remote management through applications, and the bedrock of brand trustworthiness. These discerning consumers prioritize not only the cooling effect but also the seamless integration of the unit into their living environment.

Finally, for those residing in semi-detached houses, a unique set of drivers emerges. The inclusion of installation costs within the price package, the unit’s power output, the availability of technical support, and the allure of an extended warranty converge to guide purchase decisions.

Inference and Implications

As the lingering heatwaves continue to dance across the Italian landscape, this comprehensive study casts a revealing spotlight on the intricacies of Italian consumer preferences within the realm of air conditioning. The synergy between House of Brands and independent brands unfurls through divergent purchase channels and intrinsic drivers. Further, the influence of estate types underscores the contextual nuances that shape consumer choices, creating an orchestra of variables that manufacturers and retailers must harmonize with.

In the delicate balance between cooling efficacy, aesthetics, and value-driven choices, a thorough comprehension of these dynamics remains pivotal for brands aiming to offer a breath of fresh air to Italian households. The study’s insights illuminate a path forward, providing a strategic compass for brands to navigate the diverse landscape of consumer preferences as Italy’s high temperatures gradually relinquish their hold.