Unlocking Key Insights and Trends in the Packaged Cheese Market

In the realm of packaged cheese, understanding consumer behavior is paramount for marketers seeking to navigate this dynamic and competitive market. Our recent research, conducted in early February, sheds light on the intricate nuances of this category, revealing key purchase drivers, emerging trends, and brand dynamics that shape consumer preferences, with a final touch of competitive landscape.

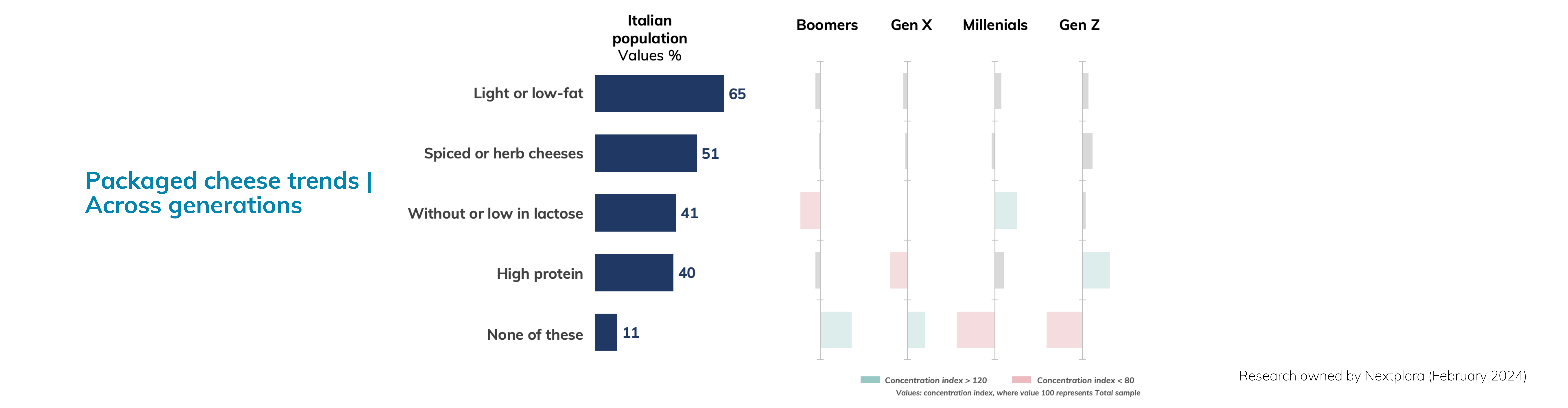

Packaged Cheese Flavors and Trends Across Generations

Our research unveils intriguing trends in packaged cheese preferences among different generations. Besides regular cheese, light or low-fat cheese emerges as the top choice, accounting for 40% of declared purchases over the past six months. This preference aligns with broader health-conscious trends, as consumers seek options that offer reduced fat content without compromising on flavor. Lactose-free variants (41%), while not as popular among older generations, find strong resonance among Millennials. The surge in demand for high-protein cheese (40%) among Gen Z hints at a broader shift towards protein-rich diets, driven by health and fitness considerations. Gen X does not find this option equally enticing. Despite spiced or herb-infused cheeses not standing out as a particularly favored option among any specific generation, their ranking as the second most purchased type suggests a consistent level of interest across generations, indicating that consumers are open to experimenting with different flavors in the packaged cheese aisle

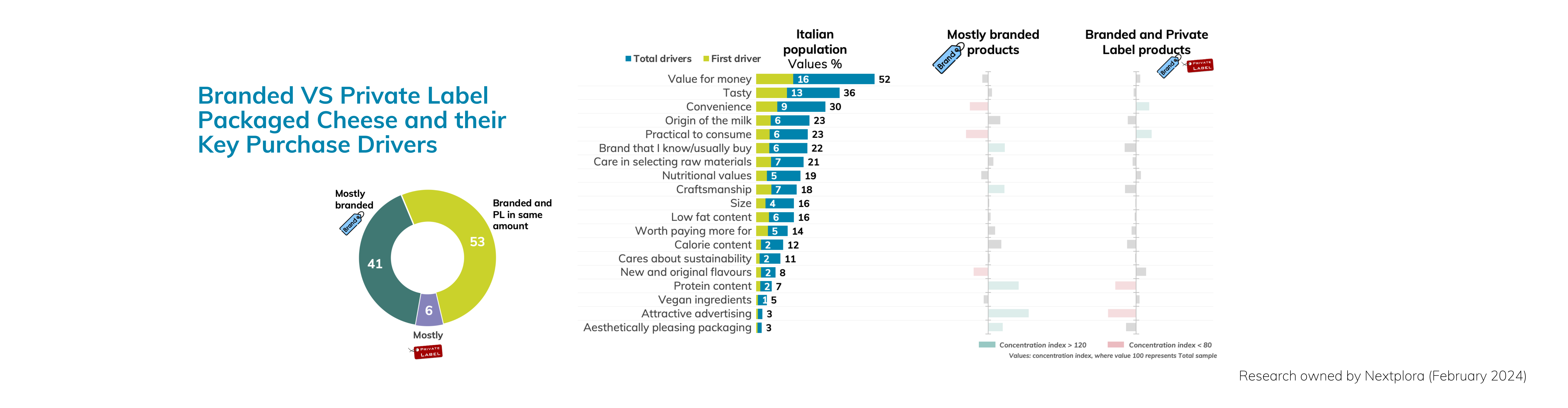

Brand Loyalty and Private Label within the Industry

The dynamics of brand loyalty and private label penetration present an intriguing dichotomy within the packaged cheese market. Branded cheese products continue to command a significant share of consumer preference, with 41% opting for familiar brands known for their quality and consistency. However, the steady rise of private label offerings signifies a growing shift in consumer behavior, as 6% of consumers opt for these alternatives. The fact that over half of consumers (53%) purchase both branded and private label cheese in the same frequency indicates a willingness to explore options across the spectrum, suggesting that while brand loyalty remains strong, consumers are increasingly open to diversifying their choices based on factors such as price and perceived value.

Ranking of Purchase Drivers

Value for money emerges as the top priority for consumers, with 52% considering it among the most important drivers of in their purchasing decisions, and 16% mentioning it as their most important one. Tastefollows closely behind, with 36% of consumers ranking it as a factor, highlighting the importance of flavor in driving purchase intent. Convenience also plays a significant role, with 23% of consumers mentioning it in their decision-making process. Notably, the origin of milk emerges as a key consideration, with 23% of consumers mentioning it, and 6% rank it as their first driver. Nutritional values are valued as a whole rather than specific components, with 19% of consumers considering them in their purchasing decisions. Protein content ranks relatively lower at 7%, while calorie content holds slightly more weight at 12%, underscoring the nuanced factors influencing consumer choices in the packaged cheese aisle.

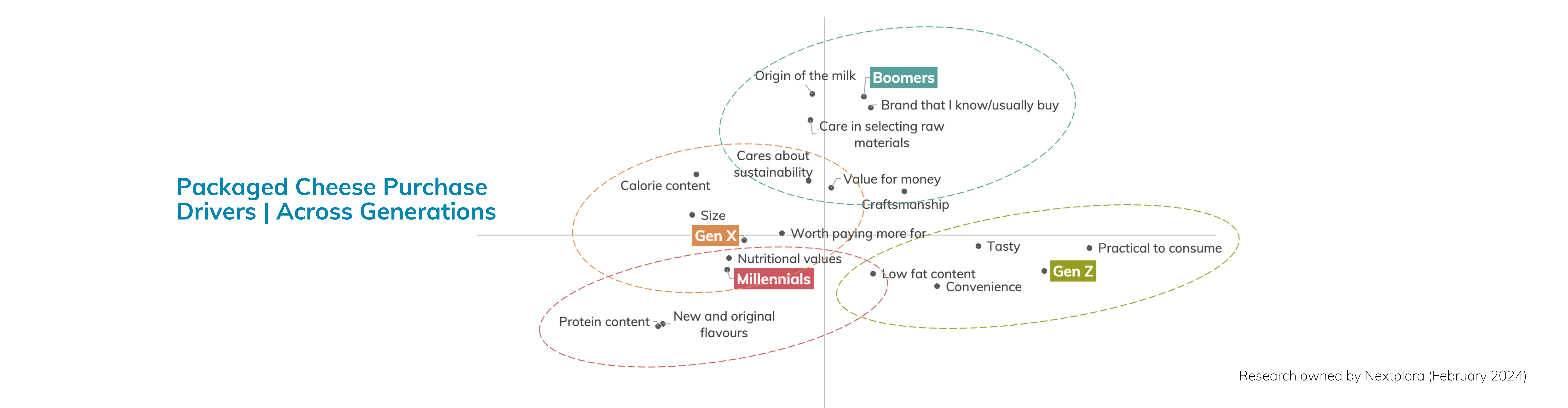

Purchase Drivers by Generation

Consumer preferences for packaged cheese vary significantly across different generations, with distinct priorities shaping their purchase decisions. Gen Z consumers prioritize practicality, taste, and convenience, seeking options that align with their fast-paced lifestyles. Both Gen Z and Millennials share a preference for low-fat content, reflecting a broader trend towards healthier eating habits. However, Millennials also prioritize new and original flavors, as well as protein content, indicating a desire for variety and nutrition. Gen Xconsumers, while also valuing nutritional values, place additional emphasis on factors such as product worth, size, and calorie content. In contrast, Boomers prioritize factors such as milk origin, selection of raw materials, and brand familiarity, drawing upon their experience and preference for trusted options. Despite these generational differences, both Boomers and Gen X consumers prioritize good value for money, highlighting the universal appeal of affordability and quality in the packaged cheese market.

Purchase Drivers and Branded vs. Private Label Products

Delving deeper into the factors driving consumer choices between branded and private label products reveals intriguing insights into their decision-making process. Branded products often leverage factors such as milk origin, raw material selection, and product value to appeal to consumers seeking assurance of quality and authenticity. In contrast, private label offerings emphasize practicality and value, positioning themselves as viable alternatives that deliver on both quality and affordability. The shared considerations of taste and sustainability highlight common priorities among consumers, regardless of their choice between branded and private label options.

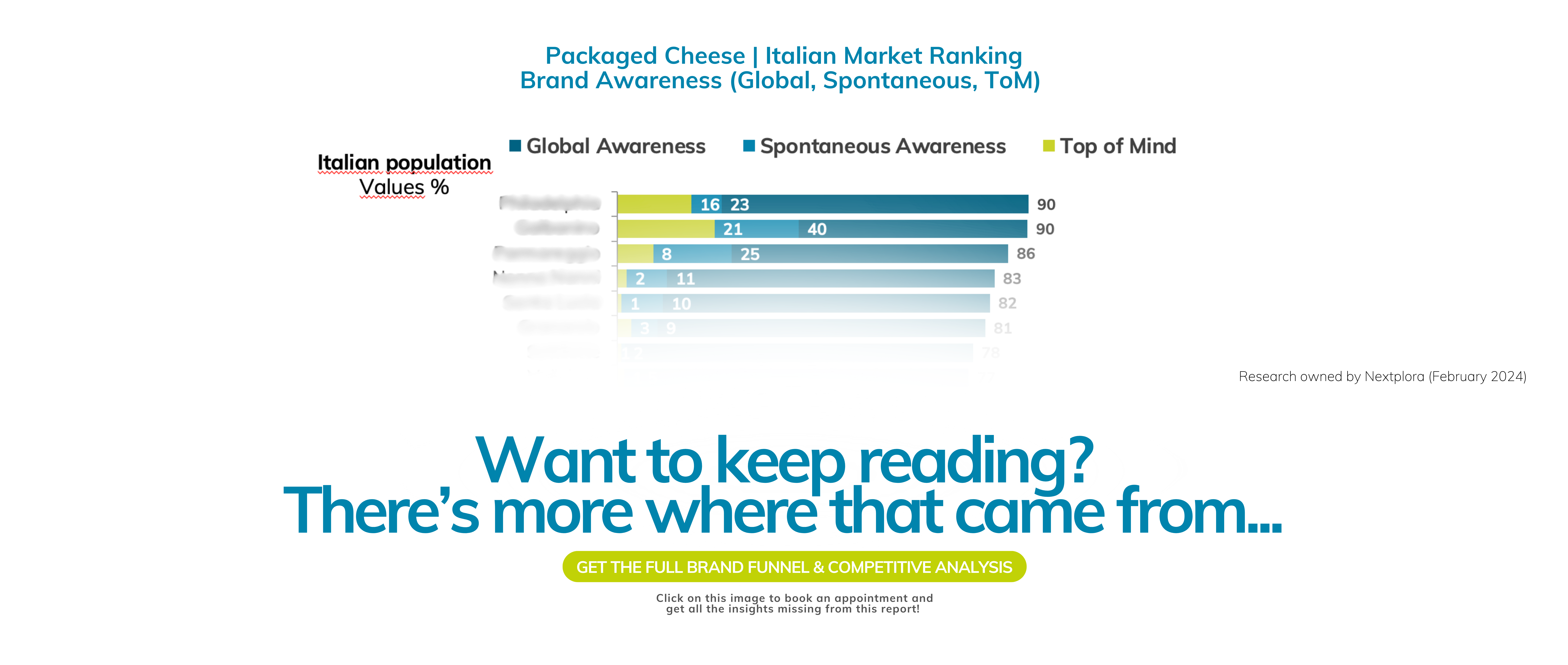

Brand Funnel and Competitive Landscape

Our ongoing research into brand performance within the packaged cheese category uncovers a wealth of data encapsulating key brand funnel KPIs, including brand awareness, consideration, usage in the last 3 months, and loyalty. This comprehensive analysis provides valuable insights into the competitive landscape of the market, offering marketers actionable intelligence to refine their strategies and drive brand success.

Let’s take a look at the brand awareness ranking in the Italian packaged cheese market first…

Inside Italy's Gaming Habits: Exploring Trends and Generational Shifts

On the occasion of Game Week in Milan on Nov. 24, 25 and 26, we thought we would bring you research dedicated to video games and specifically, an in-depth exploration of Italy's gaming landscape across diverse generations. In this comprehensive study, we've thoroughly examined the gaming behaviors prevalent among Italians, uncovering intriguing insights that showcase how gaming preferences vary across age groups, favorite console or genre.

This study is based on a representative sample of 500 individuals, meticulously selected to mirror the Italian population's diversity in terms of age, gender, and geographic distribution. To kick things off, consider this statistic: Italians engage with video games 4.1 times a week, accumulating 17.5 times a month on average. Notably, Millennials lead in gaming frequency, closely followed by Gen Z and Zillennials.

Keep reading and join us on this journey as we unravel the intricacies of Italy's gaming landscape, offering comprehensive insights into the varied preferences and behaviors that shape the country's gaming community.

Favorite Console

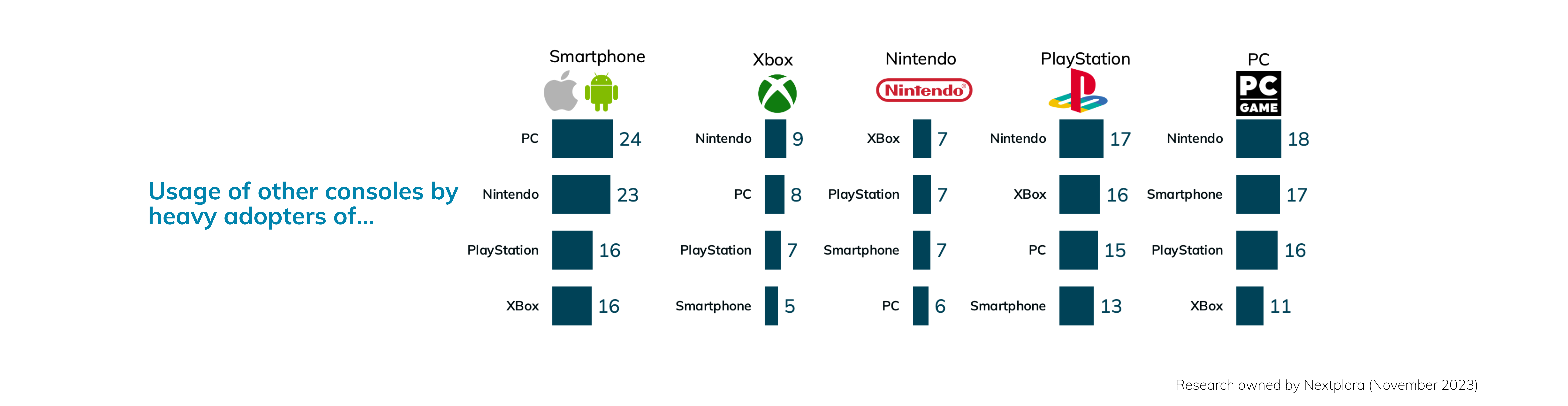

Gamers predominantly using Nintendo and Xbox consoles tend to stick solely to their chosen platforms without much crossover to other gaming systems. Their loyalty to Nintendo or Xbox results in a preference for an almost exclusive gaming experiences on these consoles.

However, an interesting trend emerges among individuals primarily engaged with PlayStation, Xbox, or PC. Nintendo consistently appears as their secondary favorite. This preference for Nintendo as a secondary choice likely stems from its portability. Unlike the less mobile PlayStation, Xbox, and PC systems, Nintendo's portable nature enables gaming outside the home, facilitating gameplay during travel or on-the-go situations like train journeys or trips.

This distinction highlights the unique appeal of Nintendo consoles as an additional option among individuals primarily engaged with other gaming platforms.

Favorite Genre by Generation

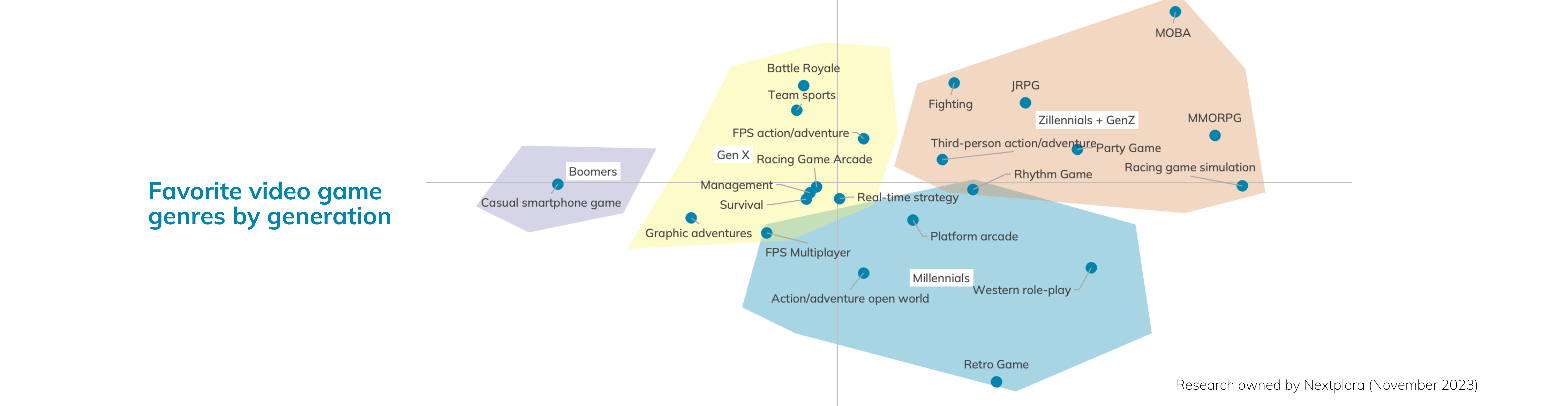

The generational divide in gaming preferences is evident: Gen Z and Zillennials favor JRPGs, party games, and third-person action-adventure. Millennials lean towards action-adventure, open-world games, platform arcades, and Western role-playing games. Gen X embraces a wide spectrum, from team sports and racing to management, survival, and real-time strategy games. Remarkably, Boomers predominantly favor casual smartphone games.

Purchase Drivers Based on Favorite Console

Understanding the key factors driving gamers' choices based on their favorite consoles provides valuable insights into diverse purchasing priorities. Let's explore the distinct preferences influencing game selection for different consoles:

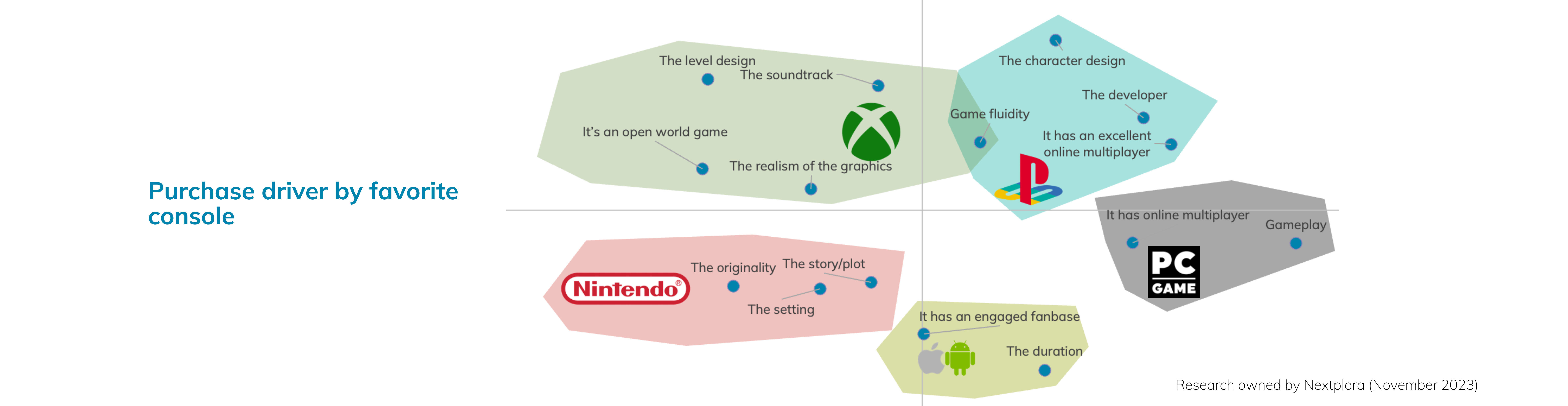

- Xbox: Prioritizes realistic graphics and open-world aspects as key drivers for game selection.

- Nintendo: Emphasizes originality, compelling storylines, and unique settings as pivotal factors guiding game choices.

- PlayStation: Focuses on character design, multiplayer options, and gameplay fluidity. Similar to Xbox users, values the fluidity of the game experience.

- PC: Values online multiplayer functionality and gameplay mechanics.

- Smartphone Games: Seeks games with engaged fanbases and enduring gameplay experiences, often preferring longer games.

Drivers Influencing Videogame Purchase

Our study looked into the key factors influencing gamers' decisions when purchasing video games. Participants were asked to identify features that would prompt them to consider buying a videogame. Subsequently, they were asked to identify features that, if present in a game, would guarantee their purchase. We then calculated a conversion rate based on these responses to determine the most influential factors in driving purchase decisions.

Top 5 Influential Drivers of Videogame Purchase:

- Storyline/Plot (53% Conversion Rate): Identified as the most influential factor, captivating narratives and compelling plotlines were cited by over half of the participants as a crucial determinant in considering a game for purchase.

- Originality (41% Conversion Rate): Uniqueness and novelty played a significant role in swaying purchase decisions, resonating strongly with the gaming community.

- Online Multiplayer (35% Conversion Rate): The presence of an online multiplayer mode significantly influenced gamers' decisions, highlighting the importance of social and interactive elements in modern gaming experiences.

- Gameplay Mechanics (34% Conversion Rate): The quality of gameplay mechanics, including controls, interactions, and overall playability, emerged as a pivotal factor in purchase decisions.

- Realistic Graphics (33% Conversion Rate): While not the primary factor, realistic and visually appealing graphics held considerable sway in influencing gamers' choices.

Another compelling topic gaining traction in the global video game world is cloud gaming. Cloud gaming, a technology allowing users to stream games through the internet without the need for high-end hardware, has gained attention in the gaming sphere. Notably, in our survey, respondents showcased divided awareness regarding Cloud Gaming, with 45% acknowledging familiarity while 55% remained unaware of this gaming innovation.

These insights underscore the pivotal role of narratives and originality in engaging gamers across generations. Despite the industry's focus on multiplayer integration, the allure of a captivating storyline remains paramount. Understanding these preferences equips marketers to tailor their advertising efforts to distinct age groups, fostering deeper engagement with the brand and its products by tapping into the enduring appeal of immersive storytelling and unique gaming experiences.

The Stanley Cup Incident: Leveraging User-Generated Content to Boost Brand Loyalty

In the world of outdoor gear, few brands have captured the imagination quite like Stanley. Their products, designed for the rugged outdoors, became synonymous with reliability and durability. Yet, an unforeseen moment catapulted this brand into a spotlight it never anticipated.

The Essence of Stanley

Stanley specializes in crafting camping gear and outdoor accessories tailored for the adventurous souls. From heavy-duty thermoses to sturdy drinkware, their offerings promise to weather any adventure, appealing primarily to outdoors enthusiasts.

Viral Breakthrough: Stanley's TikTok Triumph

The unexpected happened when Stanley's tumbler went viral on TikTok, sparking a frenzy that caught everyone off guard. The hashtag #StanleyTumbler took the platform by storm, accumulating a staggering 804 million views and reshaping the brand's trajectory. The rugged appeal of Stanley's products seemed to resonate beyond the typical outdoor enthusiast, attracting a broader audience intrigued by its promise of thermal insulation and spill-proof design.

Remarkable Growth: The Numbers Behind Stanley's Success

In recent years, Stanley has experienced remarkable growth. Sales of their tumbler saw a staggering 275% increase from 2020 to 2021, as per Terence Reilly, the global president of Stanley. Moreover, Stanley Black & Decker's annual revenue surged, hitting $15.281B in 2021, marking a 19.85% increase from the previous year, and reaching $16.947B in 2022, showing a further 10.9% rise.

Danielle's Incidental Impact: A Story of Resilience

In a recent viral sensation on TikTok, Danielle's harrowing experience turned into an unexpected marketing triumph for Stanley. After her car was ravaged by a fire, her video showcasing the survival of her Stanley cup, still intact with ice despite the inferno, became an instant sensation, garnering over 100 million views.

What made this incident powerful wasn't just the compelling narrative of survival but also Stanley's astute response. Instead of treating this as a mere influencer marketing opportunity, the brand embraced it as a chance to connect authentically with their audience. They didn't just offer to replace Danielle's cup; they went above and beyond by also replacing her vehicle. This move showcased genuine empathy and care for their customers beyond mere product promotion.

Moreover, the sheer exposure generated by Danielle's viral video was invaluable. The visibility it provided Stanley likely resulted in a substantial uptick in sales. The overwhelming interest and demand for their cups post-video undoubtedly translated into significant revenue.

This surge in sales essentially transformed the act of replacing Danielle's car into a strategic move rather than a solely altruistic one. The investment in a new vehicle for Danielle, when weighed against the revenue from increased cup sales due to heightened visibility, became a calculated and shrewd business decision. In essence, the brand's bold move not only showcased empathy but also proved to be a savvy marketing strategy.

This incident highlights the stark contrast between orchestrated influencer marketing and authentic user-generated content. Often, influencer campaigns can come off as contrived and detached from reality, featuring polished influencers endorsing products in glamorous settings. However, Danielle's raw and unfiltered experience resonated deeply with audiences. It was a genuine moment of connection that consumers could relate to on a human level, far removed from the staged scenarios of traditional influencer marketing.

This authenticity is the heart of the matter. It's the power of real-life stories, shared by everyday people, that can create lasting impacts and emotional connections. Danielle's tragic yet relatable experience struck a chord, emphasizing the resilience of the Stanley cup in a way no scripted influencer vlog ever could.

What Stanley did brilliantly was to recognize the power of authenticity and the resonance of real-life stories. By responding with generosity and concern, they not only showcased the resilience of their product but also portrayed themselves as a brand that cares about its customers.

This move didn't just pay off in terms of visibility; it created a wave of positive sentiment and loyalty within their fan base. The outpouring of support and admiration from viewers further solidified Stanley's position as a brand that stands by its customers.

This incident underscores a crucial lesson for marketers: harnessing user-generated content isn't solely about going viral; it's about leveraging genuine, unscripted moments to build lasting connections. Stanley didn't chase the viral video; they embraced the opportunity to stand by their product and their community.

In essence, this incident redefines the narrative of brand engagement, showcasing the immense potential in turning unforeseen situations into moments of genuine connection. Stanley didn't just restore a cup and a car; they strengthened their brand's resilience and loyalty in the hearts of their consumers.

As marketers, it's crucial to recognize these moments, seize them authentically, and use them not just to promote products but to build lasting relationships with our audience.

Subscription Models and their Impact on Consumers and Industry Dynamics

Subscription-based business models have experienced exponential growth, fundamentally altering how consumers access products and services across various sectors. This transition from traditional one-time purchases to recurring subscriptions reflects shifting consumer behaviors and market trends, significantly reshaping the dynamics of business-consumer relationships.

Subscription Models: A Growth Trajectory Backed by Data

Over the past decade, subscription-based businesses have witnessed a remarkable 300% growth rate. This surge underlines the allure of subscriptions—establishing a steady revenue stream and fostering stronger, more enduring customer connections. However, the proliferation of streaming services and apps transitioning to subscriptions has led to consumer fatigue, compelling individuals to reassess the value proposition of each service amid an abundance of choices.

Diverse Industry Adoption Beyond Tech

The subscription model's reach extends far beyond the tech sphere. Industries like food chains and hospitality have embraced this paradigm shift. For instance, Pret a Manger's subscription service offering unlimited monthly coffee for a fixed fee highlights the model's adaptability across diverse sectors, showcasing its potential beyond traditional tech-based applications.

Pret a Manger's Subscription Success: Unlocking Revenue and Fostering Loyalty

Pret a Manger's subscription program has yielded remarkable results since its inception. The program's utilization soared to over 667,000 times per week in 2021, escalating further to millions of redemptions weekly in 2022. The standout statistic lies in the spending behavior of subscribers, who typically spend four times more than non-subscribers, elucidating the program's impact on driving substantial revenue growth. Notably, the half-year revenue for 2022 skyrocketed by an astounding 230%, surging from £155.4 million to £357.8 million compared to the same period in 2021.

Expansion and Engagement: Key Indicators of Success

The program's expansion beyond its native grounds to the US and France speaks volumes about its success and potential scalability. However, beyond mere revenue spikes and program expansion, the robust engagement of subscribers and their high levels of incremental spending stand as the truest indicators of a thriving program. Pret's team, recognizing the subscription program as a "Key Driver" of customer loyalty, reinforces the program's strategic alignment with fostering lasting customer connections.

Insights for Local Businesses: Leveraging Subscription Models for Growth

While Pret a Manger isn't a small local business, its subscription model offers crucial lessons for smaller enterprises. The staggering success of millions of subscription redemptions underscores significant consumer demand and the value proposition that local businesses can harness. Notably, for smaller establishments, the subscription opportunity presents a unique chance to foster a sense of membership and belonging among customers.

Unlocking Success: Beyond Monetary Incentives

The success of Pret's subscription program isn't solely reliant on monetary offerings like one-month free trials. Instead, it underscores the significance of offering value to customers while creating a distinct consumer experience that forges meaningful connections and a sense of belonging, ultimately fostering loyalty and long-term engagement. Subscription models, when executed strategically, offer local businesses a powerful tool to not just drive revenue but to establish enduring customer relationships built on mutual value and connection.

Meta's Pivot to Subscription: An Industry-Wide Reckoning

Empowering Users with Choice

Meta's recent announcement introduces a pivotal change for European users. Residents in the European Union, European Economic Area, and Switzerland now have the freedom to opt for a monthly subscription, liberating them from the influx of advertisements on Instagram and Facebook.

Addressing Privacy Concerns

This shift isn't just about an ad-free browsing experience; it directly tackles lingering concerns regarding data privacy and behavioral tracking—a significant stride aligning with evolving European regulations that prioritize user consent and data protection.

Price Points and User Decision-Making

Priced at €9.99/month (Web) or €12.99/month (iOS and Android), this subscription model presents users with a straightforward choice: an ad-free environment in exchange for a fee. This divergence from Meta's heavy reliance on advertising revenue, nearly 97% of its total earnings, showcases the company's adaptation to regulatory pressures and changing market dynamics.

Consumer Dilemma: Value vs. Financial Implications

However, as users weigh the value proposition of an ad-free experience against its cost, concerns surface regarding subscription fatigue and the cumulative expenses incurred from multiple subscriptions. This presents an intriguing paradox—a more refined browsing experience juxtaposed with potential financial implications and questions about oversaturation in an increasingly crowded subscription market.

Regional Constraints and Global Expansion

While this change brings about a significant alteration for European users, uncertainties loom over its potential expansion beyond Europe. The unanswered queries about its viability and reception in other markets, especially in the United States, leave a space of ambiguity.

A Dynamic Shift Reflecting Changing User Preferences

Meta's strategic move toward ad-free subscriptions in Europe signifies a multifaceted evolution. This pivotal change, driven by regulatory compliance and user-centric considerations, highlights the intricate balance between revenue diversification, user preferences, and industry adaptations in the subscription-based economy.

Navigating a Dynamic Digital Landscape

This shift not only empowers users with choice but also presents a paradigm of user-centric initiatives, shaping the ever-evolving digital ecosystem. As users navigate this choice-driven landscape, concerns about costs, subscription fatigue, and market saturation linger, reflecting the evolving dynamics of the subscription-based model.

Challenges: Navigating Subscription Fatigue and Value Proposition

The rising concern of subscription fatigue finds consumers reevaluating the necessity of each subscription. Businesses grapple with the imperative to continuously innovate and deliver tangible value to justify recurring expenses. Adapting to shifting consumer preferences and providing flexible subscription tiers becomes paramount for retaining customer loyalty in a landscape inundated with choices.

Adapting to a Consumer-Centric Landscape

The surge in subscription models isn't transient; it signifies a fundamental transformation in consumer engagement. Addressing challenges such as subscription fatigue and consistently delivering compelling value propositions are critical for businesses seeking longevity in this evolving landscape. Customizing offerings to suit consumer preferences and crafting tailored experiences will define success in this rapidly evolving domain. Subscription models signify not just a shift in revenue models but a pivotal transformation in how businesses and consumers interact and perceive value in the contemporary market.

The evolution of subscription-based models transcends mere transactional exchanges; it underscores a paradigm shift in how businesses cater to and engage with their consumers across industries.

Trick or Treat? The indulgence of impulse-purchased sweets

Halloween, with its eerie charm and the promise of sweet delights, beckons us to explore the world of impulsive sweets purchases. In the spirit of this spooktacular season, we embarked on a captivating journey to uncover the secrets behind our favorite sweet indulgences and investigated Italians' taste in “spur-of-the-moment" treats and discovered interesting insights. Let's take a look at them together!

Impulsive Purchase of Sweets

Sweet Tooth's Delight:

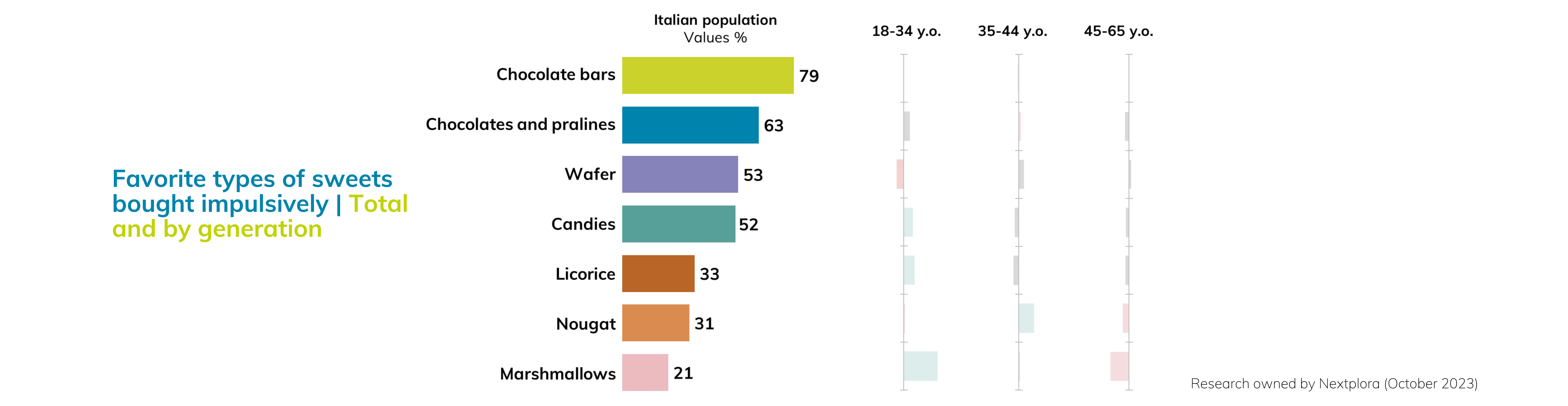

Our first question aimed to identify the product categories that fall under Italians' idea of sweet purchased on impulse or on the craving of the moment, and thanks to their answers we were able to appreciate how their hearts instantly gravitated toward the irresistible allure of chocolate bars (79%). The rich, creamy indulgence is followed closely by the ever-tempting chocolates and pralines (63%). Not far behind, the crispy satisfaction of wafers (53%) and the nostalgic charm of candies (52%) keep our taste buds enchanted. And even in a world dominated by flavor, the whimsical marshmallow, while not deeply ingrained in Italian culture, captures the hearts of 21% of impulsive sweets buyers.

Age Matters

Our sweet preferences, as it turns out, are not set in stone but sway gracefully with the winds of age. The younger generation, aged 18-34, has a soft spot for marshmallows, their taste buds aligning with the carefree spirit of this confection. They also display a slight inclination toward licorice and candies but don't show the same fervor for wafers. The adults aged 35-44 find their passion in nougat, savoring its unique texture and taste. As for the wise 45-65 age group, they're not avid fans of marshmallows or nougat, yet they share a sweet kinship with other age brackets when it comes to other delightful confections.

Choice Drivers for Impulsive Sweet Purchases

Indulgence Meets Frugality

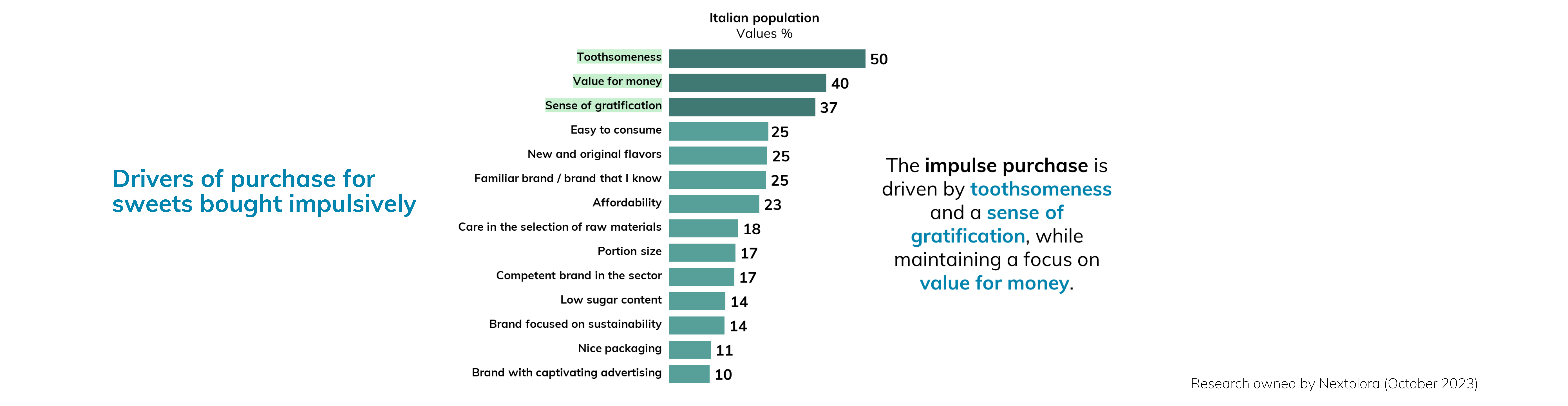

The art of impulsive sweet buying is not just a matter of whims but a careful balance between indulgence and prudence. It's no surprise that "Toothsomeness" reigns supreme as the strongest driver, with a resounding 50% of respondents affirming its sway. After all, that irresistible blend of flavor, texture, and satisfaction is the very essence of what we crave in a sweet treat. Following closely, "value for money" (40%) and "sense of gratification" (37%) serve as pragmatic compasses, reminding us to savor each morsel while being mindful of our resources.

This nuanced balance hints at a deeper undercurrent—people remain keenly aware of the price and quality ratio especially in a category of "non-essential" foods. Rising costs of basic necessities and the looming specter of inflation undoubtedly play a role in our choice of sweet indulgences.

Sweet Choices and Their Driving Forces

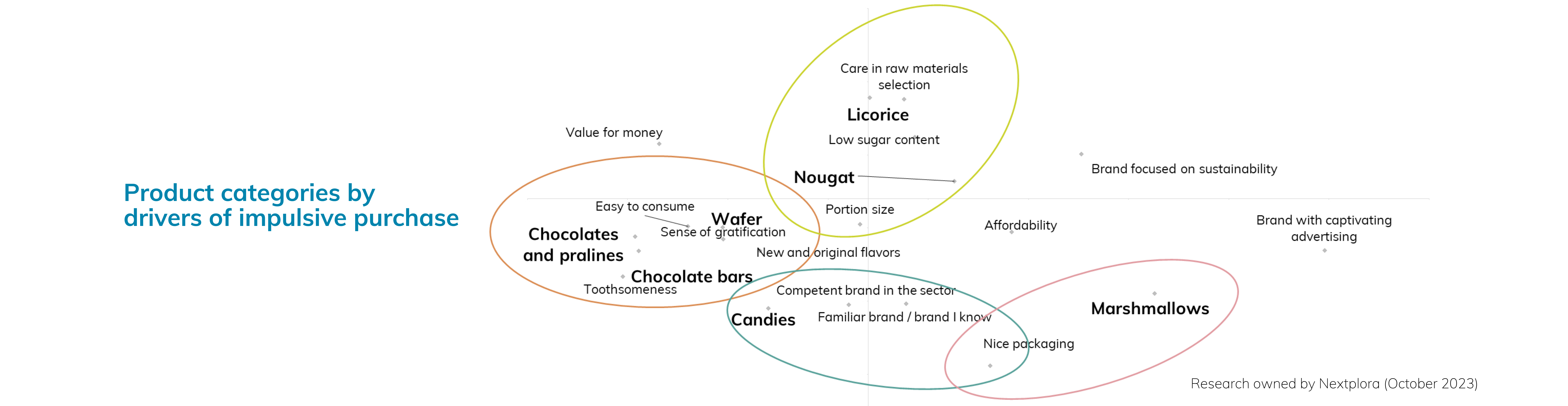

Our impulsive sweet choices are not just random. The purchase of chocolates, pralines, wafers, and chocolate bars is harmoniously driven by a trio of toothsomeness, sense of gratification, and the sheer ease of consumption. These sweets offer a symphony of flavors, textures, and the instant gratification of a delicious bite.

On the other side of the sugary spectrum, nougat and licorice enthusiasts find their motivation in the thoughtful selection of raw ingredients, lower sugar content, and portion control. These sweets invite us to savor a different kind of sweetness, one that speaks to our desire for a relatively guilt-free delight.

For marshmallow lovers, the choice driver veers toward the art of presentation—captivating packaging that promises a whimsical and joyful experience with each bite.

Lastly, candies stand as a testament to the power of trust and familiarity. What drives Italians to buy candy is their knowledge of the brand and its competence in the sector.

Festive Associations

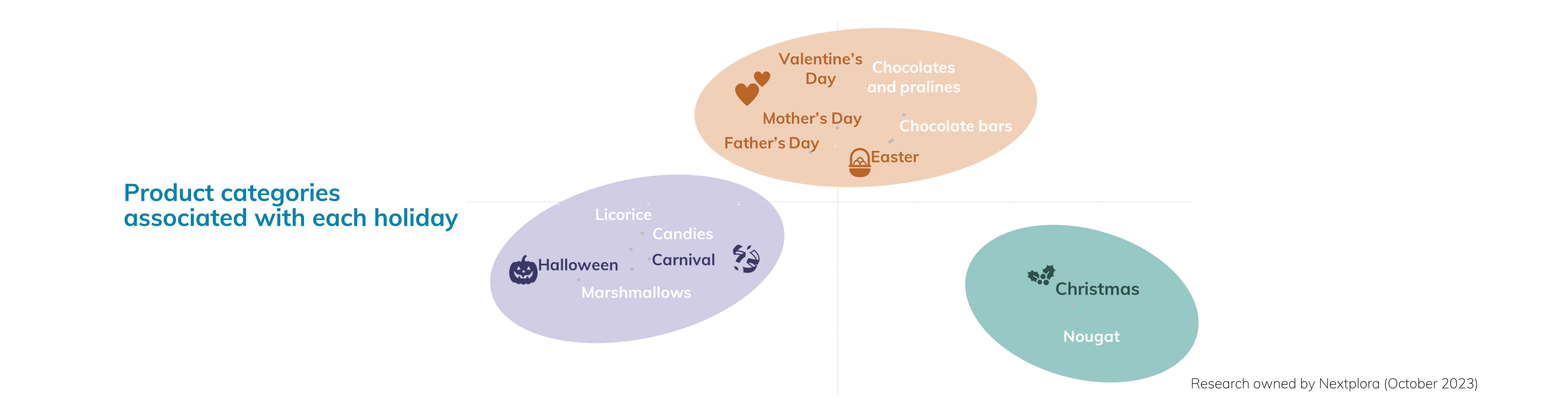

To add some seasonal context to our findings, we asked participants to associate each category of impulsive sweets with specific holidays. Here's what they told us:

- Nougat is often linked to Christmas, likely due to its traditional and comforting qualities.

- Candies, licorice, and marshmallows find their spotlight during festivities like Carnival and Halloween, aligning with the fun and celebratory nature of these events.

- Chocolates, pralines, and chocolate bars shine on occasions of love and appreciation, making them popular choices for Valentine's Day, Easter, Mother's and Father's day.

Favorite Sweet Brands for Impulse Buying

As we consider our favorite brands for impulsive sweet purchases, Kinder (43%), Nutella (39%), Lindt (38%), and Ferrero Rocher (36%) emerge as the top contenders. What's the secret sauce behind their popularity?

Just like the rest of all 10 favorite brands, they share common features: pocket-sized packaging that makes them ideal choices for those spontaneous moments of indulgence. The convenience of quick, delightful transgressions, combined with the irresistible allure of chocolate, makes them perennial favorites.

Our journey through the world of impulsive candy choices has been a whirlwind of flavors, preferences, and delight. It's a reminder that the world of sweets isn't just about indulgence—it's a reflection of our evolving tastes, our cultural celebrations, and our cravings for the perfect blend of taste and value. During Halloween, it's the perfect time to indulge your sweet tooth and savor those moments of joy.

Inclusivity in Fashion and Beauty: Embracing Diversity for Successful Branding

In today's dynamic and ever-evolving world of fashion and beauty, embracing diversity is not just a trend; it's a business imperative. Brands that prioritize inclusivity in their products and marketing strategies are not only taking a stance for social justice, but they are also reaping substantial financial rewards. This article delves into the impact of inclusivity on branding, providing examples and data that highlight the advantages of embracing diversity in the fashion and beauty industry.

A New Era of Representation

The 21st century has ushered in a new era of representation in the fashion and beauty industry. Gone are the days when the industry adhered to narrow standards of beauty and catered to only a fraction of the global population. Forward-thinking brands now understand that diversity is the bedrock of success.

One shining example is the cosmetics giant Fenty Beauty, founded by Rihanna. Fenty Beauty's groundbreaking approach to inclusivity created a buzz worldwide. By launching 40 different shades of foundation, the brand addressed the needs of a broad spectrum of skin tones. The result? An astonishing 100 million dollars in sales in the first 40 days after its launch. This data sends a clear message to professionals in the industry: embracing diversity can be immensely profitable.

The Power of Authenticity

Inclusive branding goes beyond mere representation; it embodies authenticity. Brands that genuinely connect with diverse audiences by reflecting their values, struggles, and aspirations in their products are the ones that thrive.

Take Nike's "Dream Crazier" campaign featuring Serena Williams, an iconic example of authenticity. This campaign celebrated women who have broken barriers in sports, sending a powerful message about gender equality. The result? A 7% increase in Nike's stock price, a massive social media buzz, and a boost in brand loyalty. This demonstrates the connection between inclusivity, authenticity, and the financial success of a brand.

Inclusivity in Advertising

Inclusive advertising is not just about having a diverse cast in commercials. It's about telling stories that resonate with different communities, acknowledging their unique experiences, and addressing their specific needs.

Dove's "Real Beauty" campaign is a classic example of effective inclusive advertising. By focusing on body positivity and self-acceptance, Dove engaged a vast audience. This campaign earned the brand a 60% increase in sales over a decade, proving that inclusivity in advertising creates a lasting impact on the bottom line.

Data-Driven Inclusivity

The success of inclusivity in fashion and beauty isn't just anecdotal; it's supported by hard data. Market research shows that diverse representation in advertising positively affects consumers' perception of a brand and influences their purchasing decisions.

Does diversity win?

A McKinsey & Company report titled "Diversity Wins" conducted in 2020 found a strong correlation between diversity and financial performance. The report revealed that companies in the top quartile for ethnic and cultural diversity in their executive teams were 36% more likely to achieve above-average profitability. Likewise, companies with a higher gender diversity score were 25% more likely to outperform their competitors. This research reinforces the idea that inclusivity is not only the right thing to do but also a strategic move that positively impacts a company's financial success.

This data is a wake-up call for professionals in the industry, emphasizing the need to integrate inclusivity into every aspect of brand strategy.

Diverse perspective make market-responsive products

And while the McKinsey & Company research is a prominent and compelling source, there are other studies and data that can further support the importance of inclusivity in fashion and beauty branding. One such source is the Harvard Business Review (HBR). In a study published in HBR, researchers analyzed 1,700 companies across eight countries and found a significant connection between diversity and innovation.

The HBR study discovered that companies with diverse workforces were not only more innovative but also had higher levels of customer satisfaction. In the fashion and beauty industry, where innovation is paramount, this data underscores the critical role diversity plays in driving success. It suggests that diverse perspectives lead to more creative and market-responsive products, ultimately translating into higher customer satisfaction and brand loyalty.

Inclusivity in fashion and beauty is not just a moral imperative; it is a strategic necessity for successful branding. By embracing diversity, brands can reach new heights of profitability, authenticity, and customer loyalty.

Media Matchmakers: Aligning Brand Values with the Right Platform

In the age of digital marketing, choosing the right social media platforms for advertising is crucial. Beyond the obvious factors of audience demographics and advertising costs, understanding the underlying values and reputations associated with these platforms is equally vital. Our recent research study was aimed at uncovering the perceived values of users across several prominent social media platforms and provides some thought-provoking insights that can guide advertisers in their decision-making process.

Demographics and Platform Preferences

One of the significant findings of this research is the alignment of demographics among users of various platforms, with some intriguing exceptions. The platforms in the Meta family, YouTube, TikTok, Spotify, and LinkedIn are aligned in terms of gender representation, while Pinterest, the outlier, is used significantly more by Gen Z women. X stands out as the preferred platform for Gen Z and Gen X men, and Twitch attracts a younger male audience.

Interestingly, Instagram and TikTok are the favored choices of Gen Z users, with a notable decline in usage among the older generations. In contrast, LinkedIn caters more to Gen Z and Millennials, with Boomers not prominently engaged on any of these platforms. Notably, LinkedIn also exhibits a regional concentration, with higher usage in the north-western part of Italy.

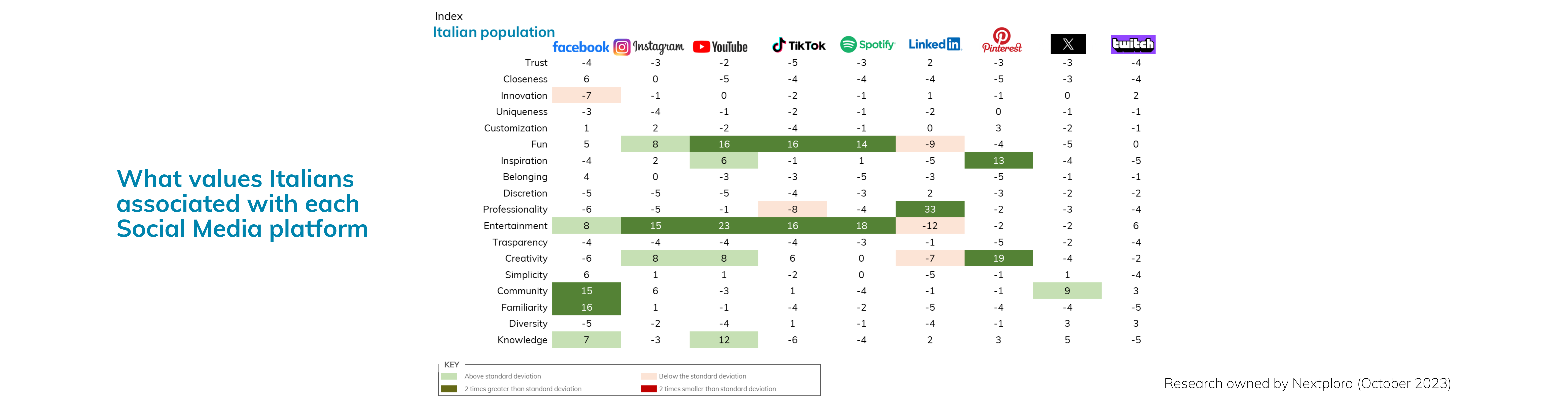

Values: Unveiling the Core

Moving beyond demographics, the study delves into the core values associated with these platforms, shedding light on the unique characteristics and reputations they convey to their users.

Discretion, Trust, Transparency, and Closeness

None of the platforms score significantly for these values, indicating that users do not perceive any of these social media platforms as notably strong in terms of transparency, trust, or discretion. This observation highlights the relatively uniform or consistent nature of these perceptions across the platforms, rather than emphasizing nuance. It's worth noting that users may not feel exceptionally close to these platforms either, signifying that building deeper connections with users is a continuous challenge for brands within this digital sphere.

Facebook:

Facebook's strong positive concentration in the Community and Familiarity categories highlights its role as a digital town square, where users connect with friends, family, and communities they identify with. Despite the negative rating for Innovation, Facebook's enduring appeal as a communal space is noteworthy.

Pinterest:

Pinterest's positive spike in the Creativity category suggests that it's a treasure trove of inspiration and innovative ideas. This niche position sets it apart from the competition.

The Quest for Uniqueness:

Interestingly, no platform stands out as particularly unique, suggesting that users do not perceive any platform as distinctly different from the rest. This opens up an opportunity for platforms to differentiate themselves more prominently.

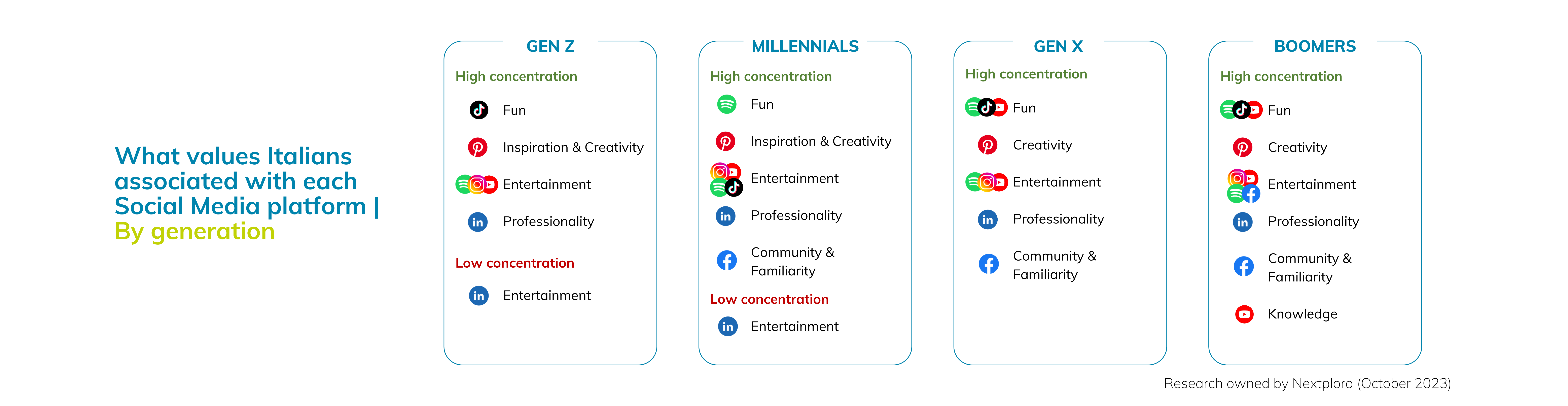

Values Across Age Groups

Unpacking values by age group further illuminates how users perceive these platforms and the unique associations they make.

Gen Z:

TikTok is the go-to platform for Gen Z, strongly associated with "Fun." Pinterest captivates with "Inspiration" and "Creativity," while LinkedIn lacks a strong association with any particular value for this generation. Facebook is not seen as an innovative platform by Gen Z, and Twitch appears closer to "Entertainment" and "Community."

Millennials:

Facebook is embraced as a "Community" and "Familiar" platform by Millennials, with a stronger association of "Closeness" compared to other generations. LinkedIn, like with Gen Z, is not considered an entertainment destination.

Gen X:

Gen X users appreciate the "Community" and "Familiarity" offered by Facebook, while Instagram, YouTube, and Spotify are valued for their entertainment content. As expected, LinkedIn maintains its professional image.

Boomers:

For Boomers, Facebook serves as a source of "Entertainment," "Community," and "Familiarity." YouTube is seen as a source of knowledge, fun, and entertainment.

In conclusion, understanding the values perceived by users on different social media platforms is crucial for advertisers. It not only helps in crafting more targeted and effective ad campaigns but also in aligning the brand message with the platform's inherent reputation. While demographic factors and advertising costs are undoubtedly significant, this research suggests that considering the values and reputations of social media platforms can provide a competitive edge in the ever-evolving world of digital marketing. Advertisers, in turn, can leverage these insights to create more resonant and targeted campaigns that align with their audience's values and expectations, fostering a stronger brand-consumer connection in the world of social media advertising.

8 Ways to Maximize the Return on Your Advertising Investment

In the constantly evolving world of advertising, maximizing return on investment is a critical challenge for companies seeking to remain competitive. With the outbreak of new platforms and advertising media, it has become more important than ever to understand how to evaluate, optimize, and adapt advertising strategies to reach desired audiences effectively and efficiently. In this article, we will explore 8 key approaches that can help you overcome challenges and maximize the impact of your advertising campaign. From evaluating metrics to tracking "incremental reach" and from managing ad saturation to real-time planning, we will discover how to address these issues in smart and innovative ways.

1. "How can I evaluate or reconcile the myriad of metrics reported by each medium?”

Every media planner's dream:

Do you have ads in places as diverse as linear TV, Connected TV, YouTube, TikTok or movie theaters? Forget about reconciling fifteen different data sources & audience universes to measure its impact. A unified view of media simplifies everything. You can easily measure the total reach of the campaign, the incidence of each medium in each target and identify the duplicates between them.

Find (and fix) problems:

This approach allows you to effectively maximize your media investment, address pressing challenges such as advertising saturation on certain targets, and gain valuable insights into the optimal frequency needed to positively impact our brand perception or improve online traffic.

2. "There is a 10 percent of my target audience that I can only reach through CTVs."

The "incremental reach" thing is not all that complicated:

In recent years, a new buzzword has burst into the industry: incremental reach. As media consumption becomes more fragmented and some consumer profiles move away from traditional TV, new media must be introduced into the mix to get that incremental reach on top of traditional TV. In recent times, the spotlight has been on Connected TV.

It is as simple as thinking about a fishing area. If you only cast your net in one spot, you will lose fish. It makes sense, but the key is to move from beliefs to numbers.

- How much do these new platforms add to your total reach?

- And what frequency do they offer?

- What percentage see your ads in both mediums?

- How much does it cost you to keep adding coverage points in both mediums?

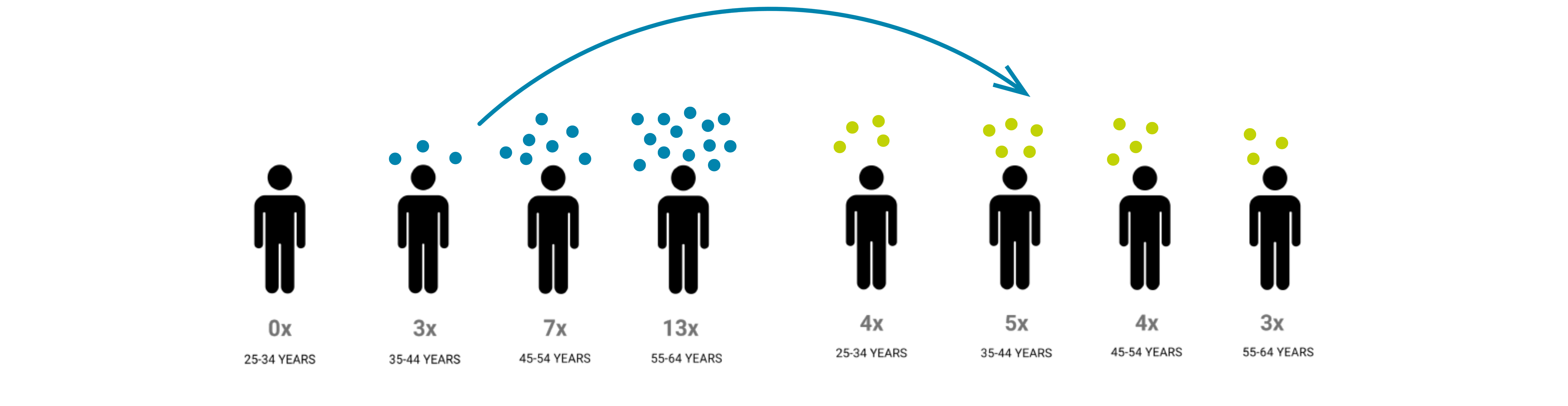

3. "We are burning out a secondary target while the primary target barely saw the ad."

Find out who sees your ads (and who sees them too much or too little) and in what media.

Ad saturation of certain target audiences is one of the big problems in the industry and affects both advertiser budgets and brand health. Its onset has much to do with poor adaptation to the fragmentation of media consumption. Following the previous example, it is as if advertisers are determined to double their efforts in a single fishing ground instead of diversifying. The most common fish in a certain spot -- such as High TV viewers -- will be "caught" several times, while others are unlikely to see the hook... With a unified media view, it will be possible to access the average frequency with which the campaign was viewed, but also by target and medium.

4. "Thanks to the investment optimizations, I was able to keep the campaign going for another week!"

Post-mortem analysis of the campaign is outdated. Make decisions while the campaign is still on the air.

Reports from traditional measurement sources arrive weeks after the campaign has ended. This limits the ability to make meaningful decisions and can reduce measurement to a simple "tick box" activity. Find out what is happening with your cross-media campaign through regularly updated reports and make on-the-fly decisions about your plan to optimize your budget.

Why do we have this information?

Because we do not depend on other sources or data fusion and we scientifically measure what is happening 24/7.

5. "I can finally measure exposure to advertising in social moments, such as watching live sports with friends."

A people meter that goes everywhere with the consumer

If you run advertisements in highly social content, such as live sports or major events, that are frequently watched at friends' or family members' homes or in public places such as bars, traditional measurement is insufficient. With an audiometer that scans the audiovisual context of the panelist wherever he or she goes with the highest accuracy and without affecting the device, the problem disappears. We get a measurement adapted to today's audiovisual consumption: device-agnostic and less anchored to specific moments, but rather dispersed and anarchic in terms of devices, moments or content categories.

Why do we have this information?

Because we made a mobile audiometer from a person's most powerful "body extension": his or her smartphone.

6. "I'm considering Twitch in my strategy, but I'd like to know how it fits into my campaign as a whole"

All the guarantees when you test a new medium.

Twitch, Netflix, TikTok, Retail Media, Podcasts, influencers or branded content of any kind... For some time now, advertising has been constantly changing. The list of platforms or formats on which you can advertise is endless and growing by the day. With Media+Brand Effect you can safely integrate them into your media mix. You can compare their reach with that of your TV or radio ads, figure out who sees them and how often, find out if they allow you to reach new audiences, etc.

7. "I found that my competitors reach Gen-Z better than I do.... How do they do it?"

How effectively do you reach your target audience?

Compare your competitors' reach on each profile with your own. Use demographic data (age, gender or region) and cross-reference it with hyperprofiling data (their socio-economic level, what financial products they have taken out and with which institution, whether they are customers of your brand or your competitors, what car they drive... and more) to get a surprising picture of the target audience you and your competitors are reaching.

How do your competitors split Linear and Digital?

And next, move on to the how... Like you, your competitors face the challenge of allocating their budget into a media plan that covers all targets.

- Find out which media and platforms they have included in their mix;

- Identify opportunities on less explored platforms;

- Find out the effectiveness of some influencers or streamers working with your competitors;

- Clarify doubts about whether or not they are present on some new platforms through their experience.

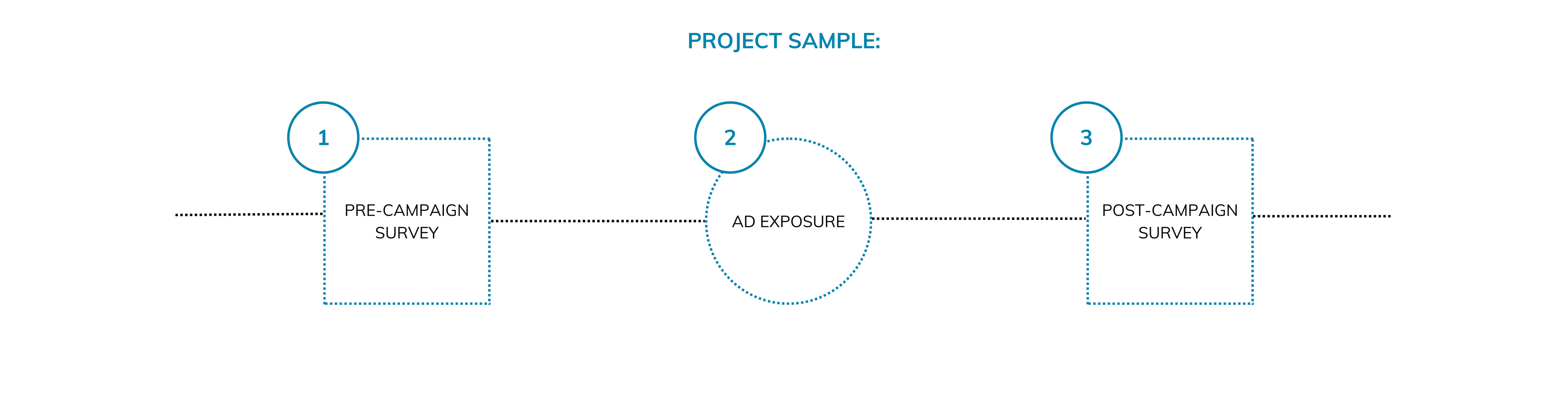

8. "Wow! Women in their 18s and 30s remember our ads better when they see them on YouTube than on TV!"

Stick with the communication and medium (or platform) that gives you the best results.

Post-tests are an established tool in the advertising world. By combining all the information about campaign exposure with the fieldwork, you will be able to determine which media generate a higher recall, what frequency is needed for your campaign to be remembered, or the difference in consideration of your brand between those exposed and those not exposed.

You may be wondering how you can put this into practice. Media+Brand Effect is the only solution that can give you these answers.

- Single source for all media:

Media+Brand Effect measures all media from a single source. This allows them all to speak the same language! This solves the current problems of measuring who-and how many times-a cross-media campaign is being viewed. - Observational measurement:

Its audio-based ACR technology allows us to go beyond declarative sources or traditional audiometers. We examine the individual's audio-visual context and exposure to any audio-visual medium. - On the same people:

Our technology is embedded in the smartphones of a permanent sample population of individuals, so all our data are obtained on the same group. This allows us to obtain a view of the entire population. In addition, exposure data can be enriched with additional layers of data, such as surveys and more.

In an increasingly complex and competitive advertising landscape, the art of maximizing return on investment is critical to the success of any campaign. We examined eight distinct ways to meet this challenge with intelligence and ingenuity, paving the way for more targeted and effective advertising. From finding new reach opportunities to real-time optimization, these approaches offer companies the ability to stay abreast of the changing needs of their audiences. The key to a successful advertising campaign lies in constantly adapting and embracing new strategies. Whether you are trying to reach a specific audience or outperform your competitors, these tactics can help you get the most out of your advertising investments and ensure that your brand remains at the center of your target audience's attention.

September Resolutions: Unveiling Aspirations for a Fresh Start

The start of September brings with it a unique sense of renewal for many Italians, akin to the rejuvenation felt at the beginning of a new year. After the blissful respite of summer holidays, Italians are ready to set their sights on new goals and resolutions. To better understand this phenomenon, we conducted a comprehensive study, delving into the aspirations of Italians for the months and year ahead. In this article, we present our findings, shedding light on the most popular resolutions, the strategies Italians plan to adopt, and even the brands that inspire them.

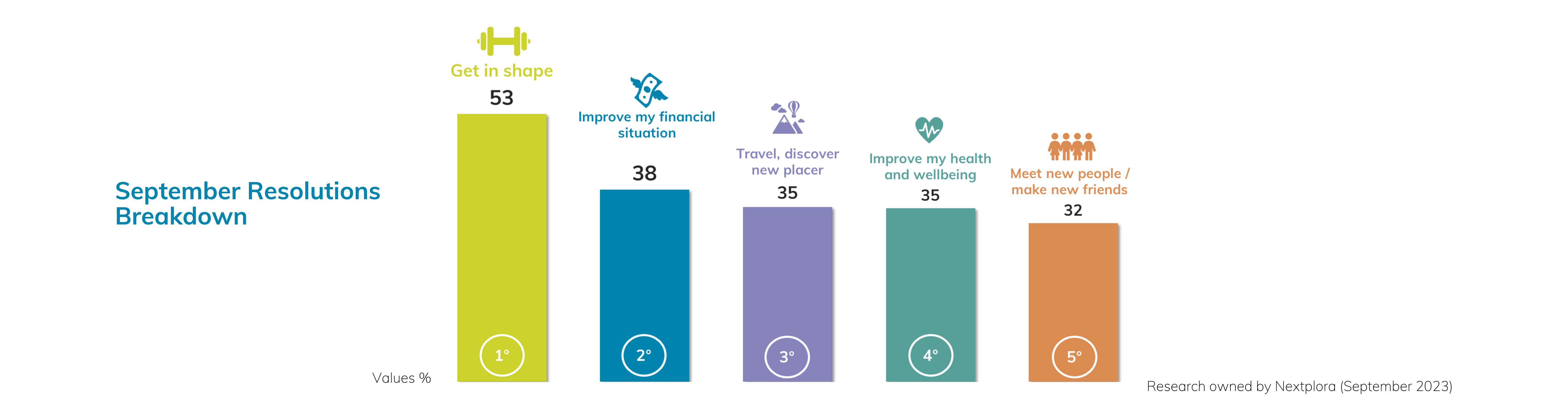

The September Resolutions

Our research reveals that Italians are eager to make positive changes in various aspects of their lives. The top five resolutions include:

- Getting in Shape (53%): A commitment to fitness and well-being.

- Improving Financial Situation (38%): A quest for financial stability.

- Traveling and Discovering New Places (35%): A desire for exploration.

- Improving Health and Well-being (35%): Prioritizing mental and physical health.

- Meeting New People and Making New Friends (32%): A pursuit of social connections.

Getting in Shape

The most popular resolution among Italians is "Getting in Shape." A staggering 53% of respondents expressed their commitment to this goal. However, when we examined how they intend to achieve this objective, some interesting trends emerged.

- Outdoor Activities (62%): Most Italians plan to start with outdoor activities like walking, running, and cycling.

- Improving Eating Habits (60%): A majority also emphasized improving their food choices and habits.

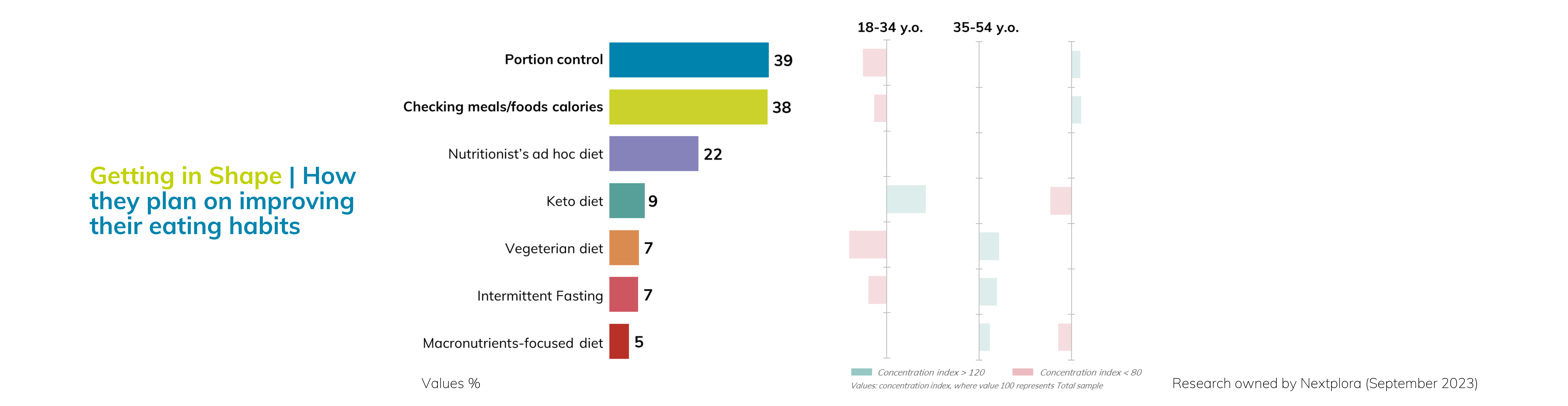

- Starting a Diet (43%): While a substantial number expressed their intent to adopt a proper diet, it was still a less popular choice compared to the Top2.

- Gym Membership (27%): Fewer individuals were willing to commit to joining a gym.

Taking a closer look at dietary preferences by age groups, we found intriguing variations:

- 18-34 y/o: This younger age group leaned towards the Keto diet and were less inclined towards vegetarianism, portion control, and intermittent fasting.

- 35-54 y/o: They exhibited a more favorable attitude towards vegetarianism, intermittent fasting, and macro-focused diets.

- Over 55 y/o: The older generation showed a preference for traditional approaches to healthy eating like portion control and calorie intake control.

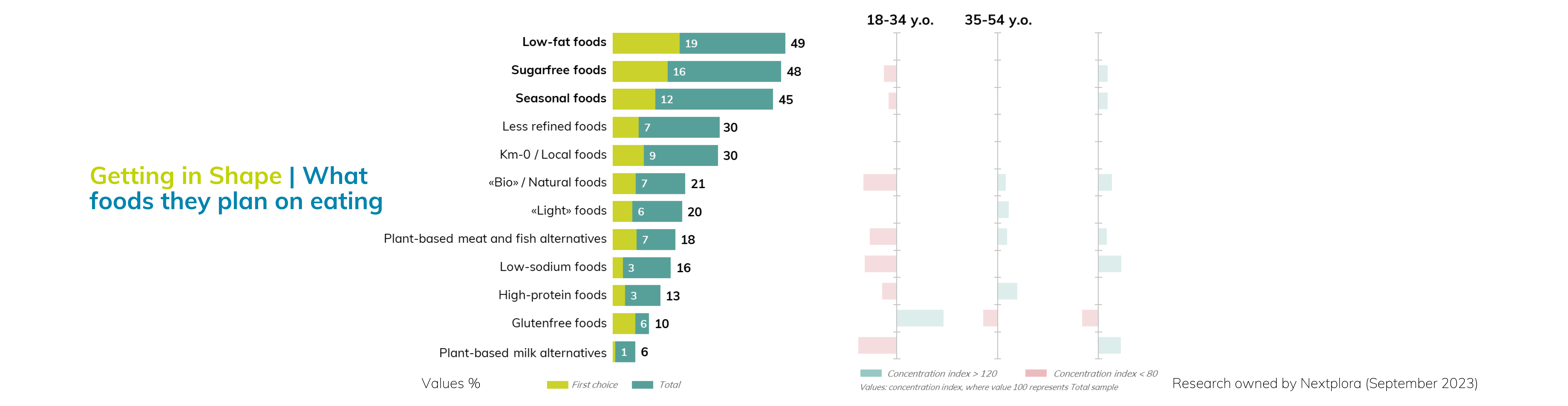

When it comes to prioritizing specific foods for their fitness journey, Italians had varied preferences:

- Low-fat Foods (49%): A top choice for many Italians.

- Sugar-free Foods (48%): Emphasizing reduced sugar intake.

- Seasonal Foods (45%): Embracing fresh, locally sourced produce.

Remarkably, the younger generation (18-35 y/o) showed a preference for gluten-free foods, while those aged 35-54 preferred high-protein foods, "light" options, plant-based alternatives, and "bio" products. The over 55 group leaned towards low-sodium options, plant-based milk alternatives, and "bio" foods.

Lastly, we explored the brands Italians associate with their goal of getting in shape, with results visualized in the accompanying graph.

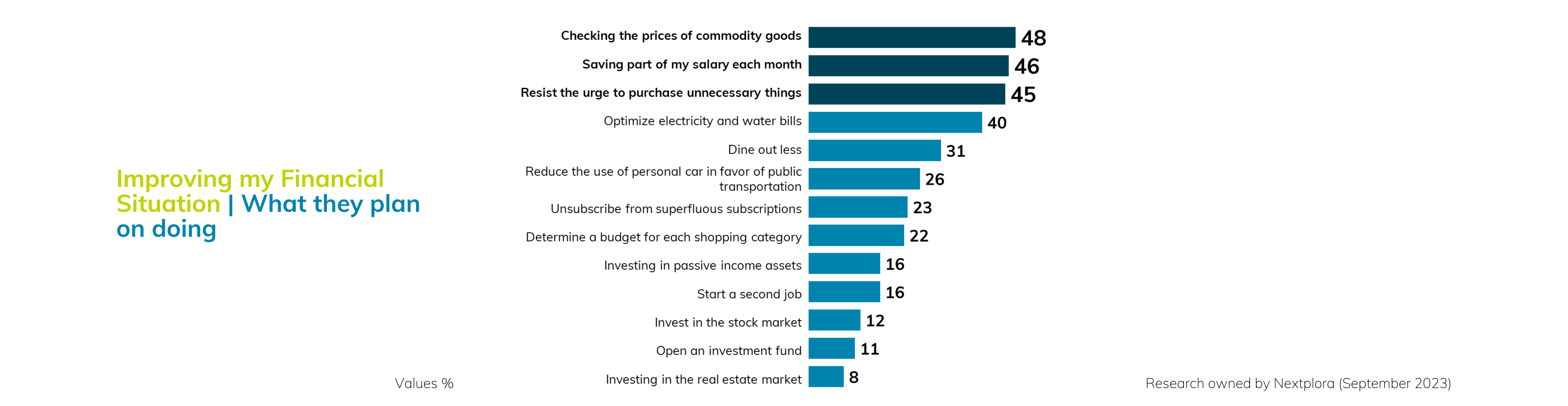

Improving My Financial Situation

The second most common resolution among Italians is "Improving My Financial Situation," with 38% of respondents committed to this objective. We delved deep into their strategies to achieve this goal:

- Careful Spending (48%): Italians plan to scrutinize commodity prices to save.

- Monthly Savings (46%): Nearly half intend to save a portion of their salary each month.

- Resisting Impulse Buying (45%): Curbing unnecessary spending.

- Optimizing Bills (40%): This includes efforts to reduce electricity and water bills.

- Eating Out Less (31%): While significant, fewer Italians intend to dine out less.

- Using Public Transport (26%): A smaller percentage plan to use public transport, despite rising fuel costs.

Similar to the fitness resolution, we also investigated the brands Italians associate with their aspirations for financial stability, with results presented in a graph below.

In September, Italians embark on a journey of self-improvement and renewal, with aspirations ranging from health and fitness to financial stability. Our research reveals not only the most popular resolutions but also the strategies Italians plan to adopt to achieve them. As we navigate these resolutions, it's evident that Italians are embracing a diverse range of approaches, reflecting their unique preferences and priorities. The associations with specific brands also provide valuable insights into the role of branding in shaping personal goals. As September already comes to an end, it is clear that Italians are seizing the opportunity for a fresh start, setting the stage for a year of positive change and growth.

The Evolution of Product Placement: Traditional Advertising vs. Native Integration

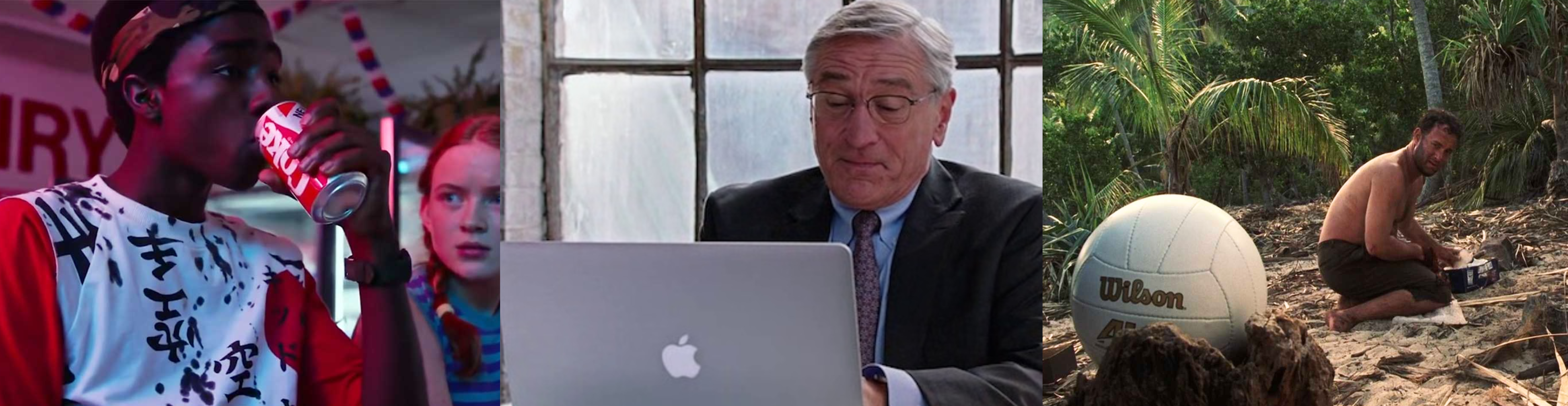

The marriage of entertainment and advertising has a storied history, with product placement acting as the connective tissue between these two realms. However, this avenue of promotion has transformed substantially, setting traditional advertising apart from the contemporary trend of native integration within movies and TV shows. This evolution mirrors shifting consumer behaviors and the pursuit of more genuine, less intrusive advertising techniques. In this article, we will delve into the effectiveness of both these approaches and shed light on the changing terrain of brand partnerships in the captivating world of entertainment.

Traditional Advertising: A Familiar Model

Traditional advertising within movies and TV shows, as we've known it, is characterized by overt displays of brands. You've seen characters sip specific soft drinks, expertly wield a particular smartphone, or cruise in a prominently featured car.

Effectiveness of Traditional Advertising:

- Viewer Awareness: Traditional advertising in movies and TV shows excels at grabbing viewer attention. A study by PQ Media in 2021 reported that branded entertainment, including product placements, reached a staggering 95% of U.S. adults aged 18-49.

- Brand Recall: These placements are memorable, often leading to high brand recall. Research conducted by a leading marketing association found that brand recall from product placements can reach as high as 81%.

- Familiarity and Trust: Traditional placements build familiarity and trust with the brand, especially when seamlessly woven into the storyline. The American Marketing Association notes that product placements often generate positive brand sentiment.

Native Integration: A Subtle Shift

In stark contrast, native integration takes a more subtle approach, seeking to organically integrate brands into the narrative. Instead of a conspicuous display, the focus is on creating an unbroken connection between the brand and the unfolding story.

Effectiveness of Native Integration:

- Enhanced Engagement: Native integration excels in capturing and maintaining viewer engagement. A study conducted by the Interactive Advertising Bureau (IAB) reported that native ads achieve, on average, a 20% higher engagement rate compared to traditional banner ads.

- Increased Purchase Intent: Native integration often leads to a higher intent to purchase. Studies reveal that integrated advertising formats, including native integration, tend to yield a 9% higher purchase intent than traditional ads.

- Authenticity and Viewer Acceptance: Native integration, frequently perceived as less intrusive, tends to be viewed as more authentic by the audience. A survey conducted in the UK market by BENlabs found that 88% of respondents reported "positive emotions" after seeing brands in TV shows, with 60% saying they have searched for a product they've seen on TV.

Changing Landscape of Brand Partnerships

The landscape of brand partnerships in entertainment is undergoing a profound transformation to meet the expectations of today's consumers. Brands are increasingly recognizing the importance of subtlety and authenticity in their advertising endeavors.

- Diversification of Strategies: Brands are diversifying their strategies, often combining traditional placements with native integration to access a broader audience.

- Digital Integration: With the surge of streaming platforms and digital content, brands are venturing into new territories such as interactive ads and e-commerce tie-ins.

- Measuring ROI: Brands are heavily investing in advanced analytics to measure the return on investment (ROI) of their entertainment partnerships, ensuring their advertising spend translates into tangible results.

Influence of Recent Blockbusters: A Barbie Case Study

Recent blockbusters like the Barbie movie have brought the influence of product placement to the forefront. These films not only serve as substantial advertisements for their respective brands but also feature various products seamlessly integrated into their storylines. This underscores the growing willingness of brands to collaborate with the entertainment industry, blurring the lines between content and advertising.

In this movie, viewers may have noticed prominent appearances by brands like Chevrolet, Chanel, TAG Heuer, and more. Chevrolet's spotless 4x4 takes a starring role, while the camera lovingly lingers on Barbie's empowering heart-shaped Chanel bag. Even Ryan Gosling, portraying Ken, sports not one but three TAG Heuer watches in a single scene. These instances illustrate how the film incorporates various products into its storyline seamlessly.

This has sparked conversations about the impact of product placement on audiences and brands. Auto Trader reported a substantial 120% increase in interest for Chevy Corvettes after the release of the Barbie movie trailer. TAG Heuer's CEO claimed that one of its watch models has been affectionately nicknamed the "Barbie watch" by customers.

As of June 2022, the global product placement industry has burgeoned into a $23 billion behemoth, marking a 14% growth in just two years. This growth underscores the eagerness of companies to be featured within movies and TV shows, especially in an era of skippable ads. Yet, it's often challenging to discern whether brands have indeed paid or provided free products for promotion in a film.

Following the remarkable success of movies like Barbie, it's likely that more product-centric films will hit the screens. However, there's an intriguing question on the horizon: will consumer enthusiasm for these nostalgic features endure, or might it eventually give way to fatigue?

Notwithstanding, the streaming universe is witnessing tech giants like Amazon and Apple entering the content creation arena. These platforms are producing their own shows, complete with strategically placed products. The question here is how viewers will perceive this approach. Will it be seen as a cynical intrusion into their content, or is it a novel way to seamlessly connect content with consumption?