In the realm of packaged cheese, understanding consumer behavior is paramount for marketers seeking to navigate this dynamic and competitive market. Our recent research, conducted in early February, sheds light on the intricate nuances of this category, revealing key purchase drivers, emerging trends, and brand dynamics that shape consumer preferences, with a final touch of competitive landscape.

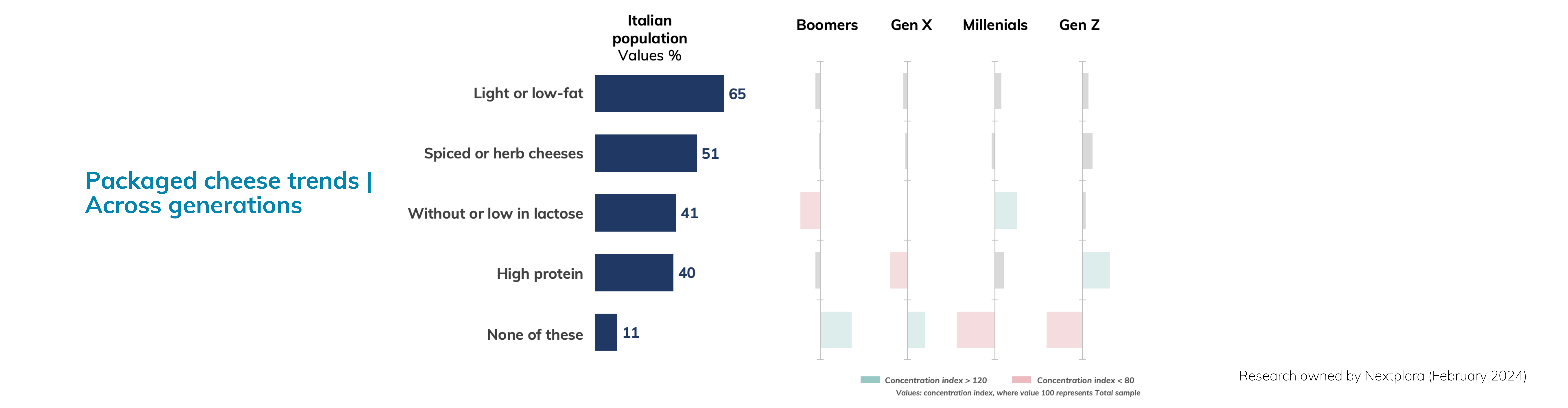

Packaged Cheese Flavors and Trends Across Generations

Our research unveils intriguing trends in packaged cheese preferences among different generations. Besides regular cheese, light or low-fat cheese emerges as the top choice, accounting for 40% of declared purchases over the past six months. This preference aligns with broader health-conscious trends, as consumers seek options that offer reduced fat content without compromising on flavor. Lactose-free variants (41%), while not as popular among older generations, find strong resonance among Millennials. The surge in demand for high-protein cheese (40%) among Gen Z hints at a broader shift towards protein-rich diets, driven by health and fitness considerations. Gen X does not find this option equally enticing. Despite spiced or herb-infused cheeses not standing out as a particularly favored option among any specific generation, their ranking as the second most purchased type suggests a consistent level of interest across generations, indicating that consumers are open to experimenting with different flavors in the packaged cheese aisle

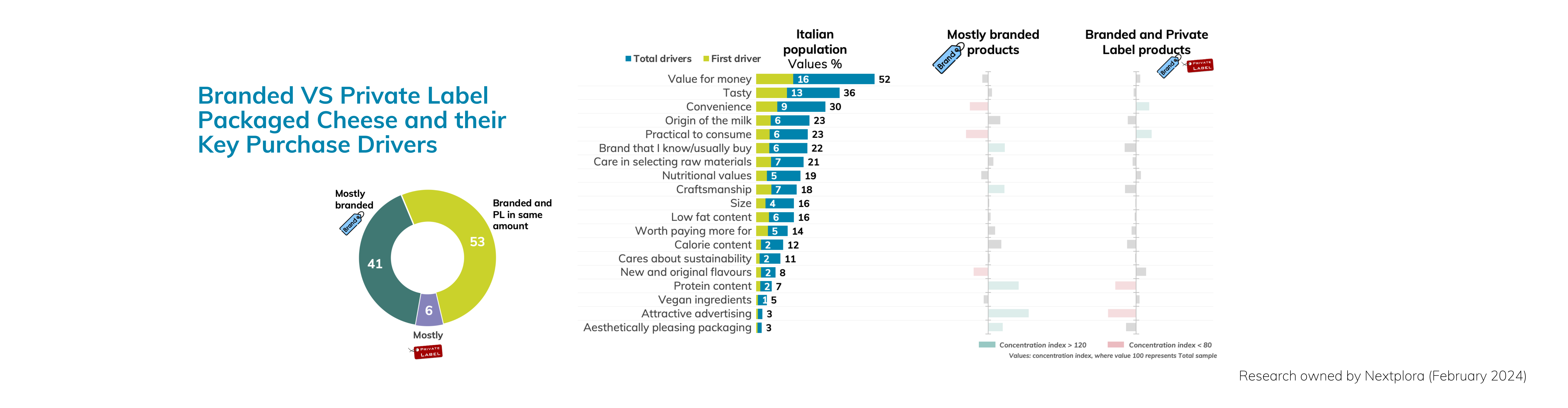

Brand Loyalty and Private Label within the Industry

The dynamics of brand loyalty and private label penetration present an intriguing dichotomy within the packaged cheese market. Branded cheese products continue to command a significant share of consumer preference, with 41% opting for familiar brands known for their quality and consistency. However, the steady rise of private label offerings signifies a growing shift in consumer behavior, as 6% of consumers opt for these alternatives. The fact that over half of consumers (53%) purchase both branded and private label cheese in the same frequency indicates a willingness to explore options across the spectrum, suggesting that while brand loyalty remains strong, consumers are increasingly open to diversifying their choices based on factors such as price and perceived value.

Ranking of Purchase Drivers

Value for money emerges as the top priority for consumers, with 52% considering it among the most important drivers of in their purchasing decisions, and 16% mentioning it as their most important one. Tastefollows closely behind, with 36% of consumers ranking it as a factor, highlighting the importance of flavor in driving purchase intent. Convenience also plays a significant role, with 23% of consumers mentioning it in their decision-making process. Notably, the origin of milk emerges as a key consideration, with 23% of consumers mentioning it, and 6% rank it as their first driver. Nutritional values are valued as a whole rather than specific components, with 19% of consumers considering them in their purchasing decisions. Protein content ranks relatively lower at 7%, while calorie content holds slightly more weight at 12%, underscoring the nuanced factors influencing consumer choices in the packaged cheese aisle.

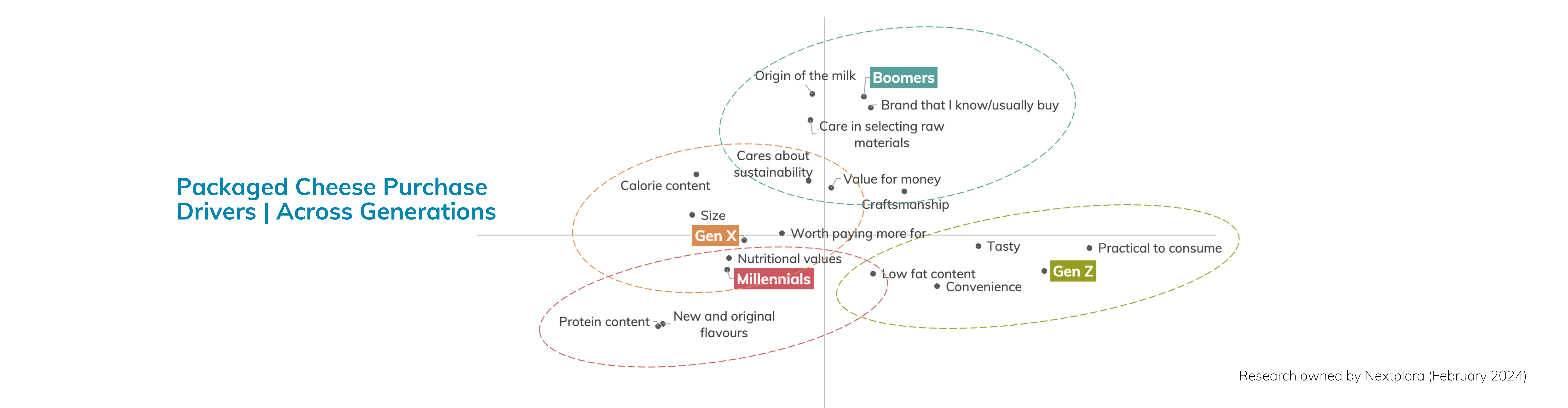

Purchase Drivers by Generation

Consumer preferences for packaged cheese vary significantly across different generations, with distinct priorities shaping their purchase decisions. Gen Z consumers prioritize practicality, taste, and convenience, seeking options that align with their fast-paced lifestyles. Both Gen Z and Millennials share a preference for low-fat content, reflecting a broader trend towards healthier eating habits. However, Millennials also prioritize new and original flavors, as well as protein content, indicating a desire for variety and nutrition. Gen Xconsumers, while also valuing nutritional values, place additional emphasis on factors such as product worth, size, and calorie content. In contrast, Boomers prioritize factors such as milk origin, selection of raw materials, and brand familiarity, drawing upon their experience and preference for trusted options. Despite these generational differences, both Boomers and Gen X consumers prioritize good value for money, highlighting the universal appeal of affordability and quality in the packaged cheese market.

Purchase Drivers and Branded vs. Private Label Products

Delving deeper into the factors driving consumer choices between branded and private label products reveals intriguing insights into their decision-making process. Branded products often leverage factors such as milk origin, raw material selection, and product value to appeal to consumers seeking assurance of quality and authenticity. In contrast, private label offerings emphasize practicality and value, positioning themselves as viable alternatives that deliver on both quality and affordability. The shared considerations of taste and sustainability highlight common priorities among consumers, regardless of their choice between branded and private label options.

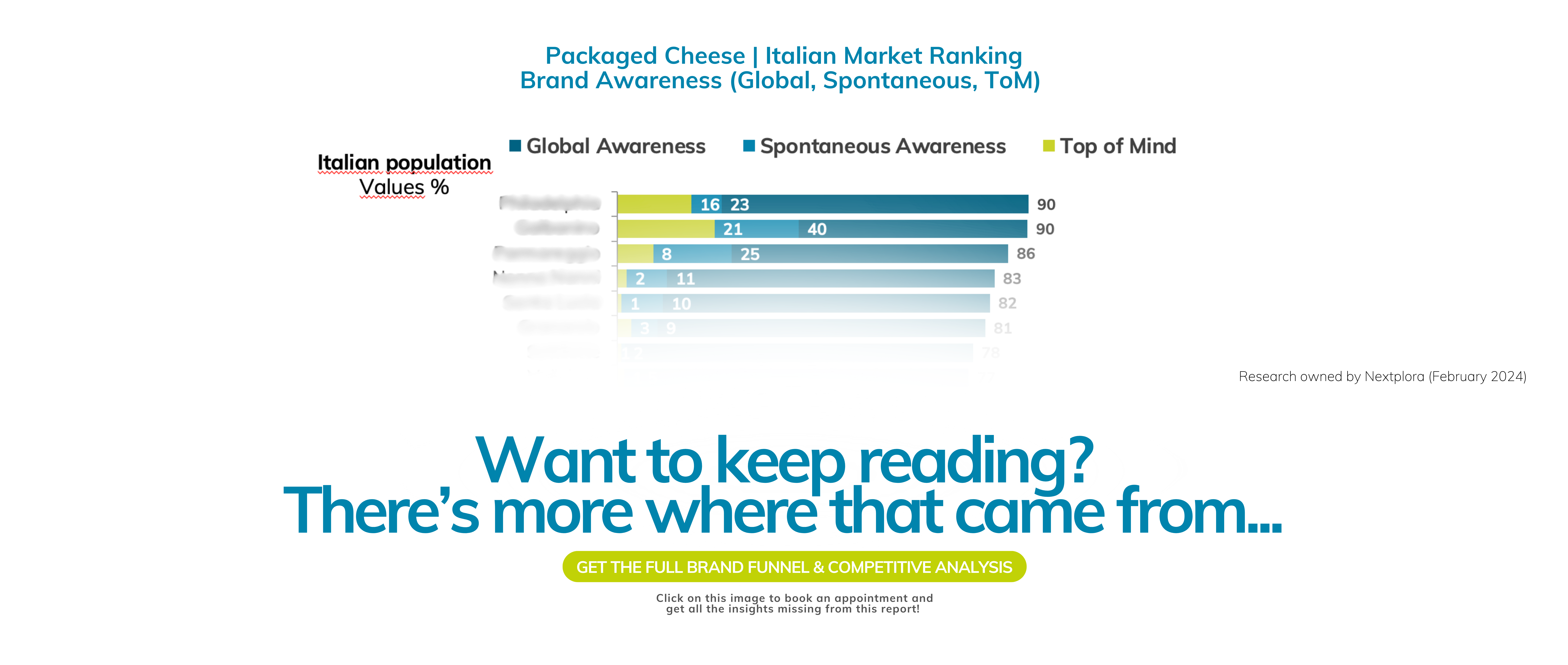

Brand Funnel and Competitive Landscape

Our ongoing research into brand performance within the packaged cheese category uncovers a wealth of data encapsulating key brand funnel KPIs, including brand awareness, consideration, usage in the last 3 months, and loyalty. This comprehensive analysis provides valuable insights into the competitive landscape of the market, offering marketers actionable intelligence to refine their strategies and drive brand success.

Let’s take a look at the brand awareness ranking in the Italian packaged cheese market first…