Easter is a time of celebration and indulgence, and for many Italians, that means enjoying one of the country’s favorite spring treats: Easter eggs. But what drives Italian consumers when it comes to choosing which eggs to buy? We at Nextplora recently conducted a study to answer that very question. The results are in, and they offer valuable insights for brands looking to capture the hearts of Italian consumers. In this article, we’ll break down the findings and explore what really matters to Italian Easter egg buyers.

Our aim was to identify the most and least important drivers of purchase for households with and without children, with a particular focus on consumers’ attitude towards food and nutrition.

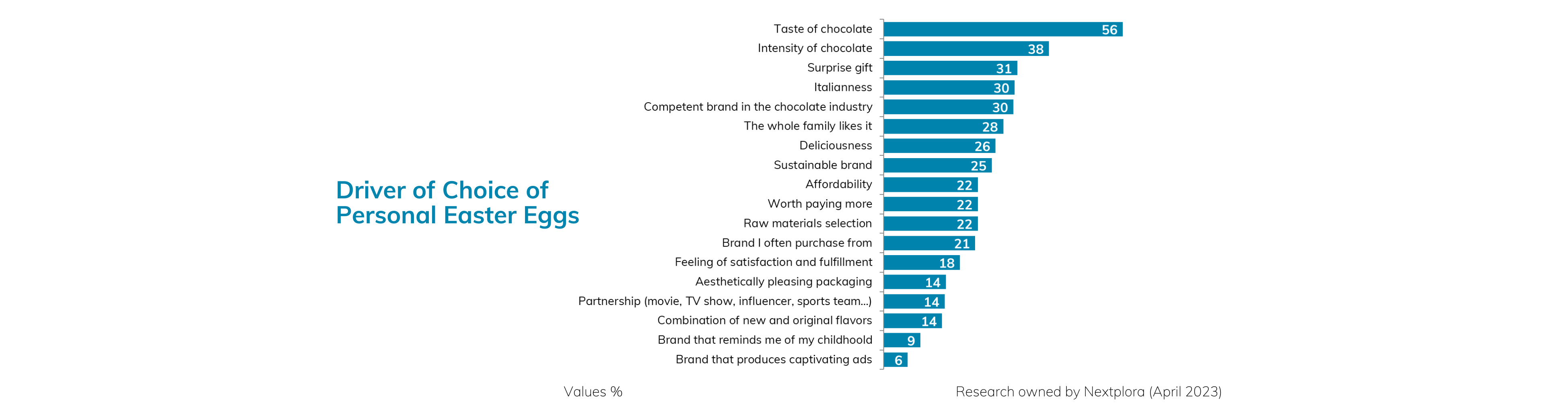

In the first graph, we outlined the drivers of choice for Easter eggs. The taste of chocolate was the most significant factor, with 56% of respondents indicating it as their primary driver. The intensity of chocolate came second (38%), followed by the surprise gift (31%). It’s noteworthy that only 9% of respondents indicated the nostalgic memory of their childhood as a driver of choice. Similarly, captivating ads did not appear to have a significant impact on consumer behavior overall. Rather, Italian consumers prioritize taste and “Italianness” over other elements. “Affordability” scored 22% of responses, but so did “worthy paying more”, which suggests that consumers are more conscious of their spending but are willing to invest more if they perceive the product as valuable. Rising prices and inflation may be contributing factors to this trend, but there are likely other factors at play as well.

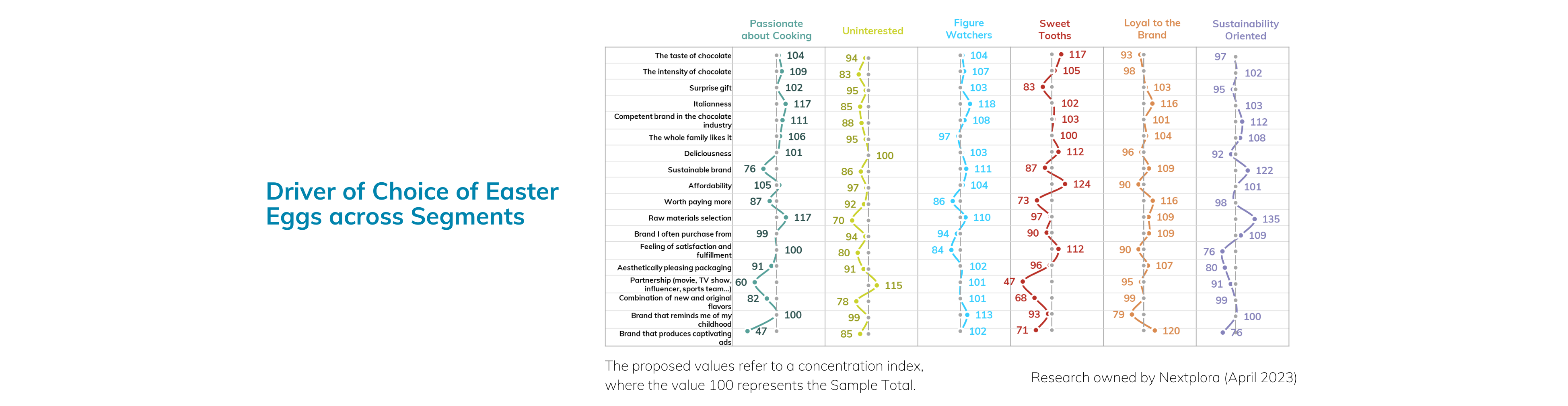

In the second graph, we delved into the drivers of choice using a segmentation analysis about consumer’s attitude towards food and nutrition. We found that consumers who were “Uninterested” in food had the highest concentration index for partnerships with movies, TV shows, influencers, and sports teams. Their responses indicated a lower priority for “Intensity of chocolate” (83) and “Raw materials selection” (70).

In contrast, the “Passionate about cooking” segment prioritized “Italianness” (117), “Competence in the chocolate industry” (111), and “Raw materials selection” (117). Consumers who are passionate about cooking are likely to have a deeper understanding and appreciation of the quality and origin of ingredients, as well as the processes involved in creating a high-quality chocolate product. This group may also be more interested in the cultural significance of food and the history and traditions of Italian cuisine.

The “Sweet Tooth” segment emphasized “Taste of chocolate” (117) and “Affordability” (124). This group of consumers is less concerned with the health benefits or premium quality of the product, and instead seeks a delicious, affordable chocolate experience, while the “Figure Watchers” segment cared the least about “Feeling satisfied and fulfilled” (84) and placed greater importance on the “Italianness” of the brand (118).

Finally, the “Loyal to the brand” segment prioritized “Italianness” (116) and “Worthy paying more” (116) and showed a high index for “Captivating advertising” (120). Consumers in this segment may be loyal to the brand because it holds a special place in their hearts, perhaps due to positive memories or experiences associated with the brand. As a result, captivating advertising may serve to reinforce the emotional connection that consumers in this segment already have with the brand. Additionally, it’s possible that consumers in this segment are more likely to be influenced by advertising in general, as they may be less price-sensitive and more brand-focused than other segments.

Lastly, the “Sustainability-oriented” segment emphasized “Raw materials selection” (135) and prioritized sustainable brands (122) and industry competence (112).

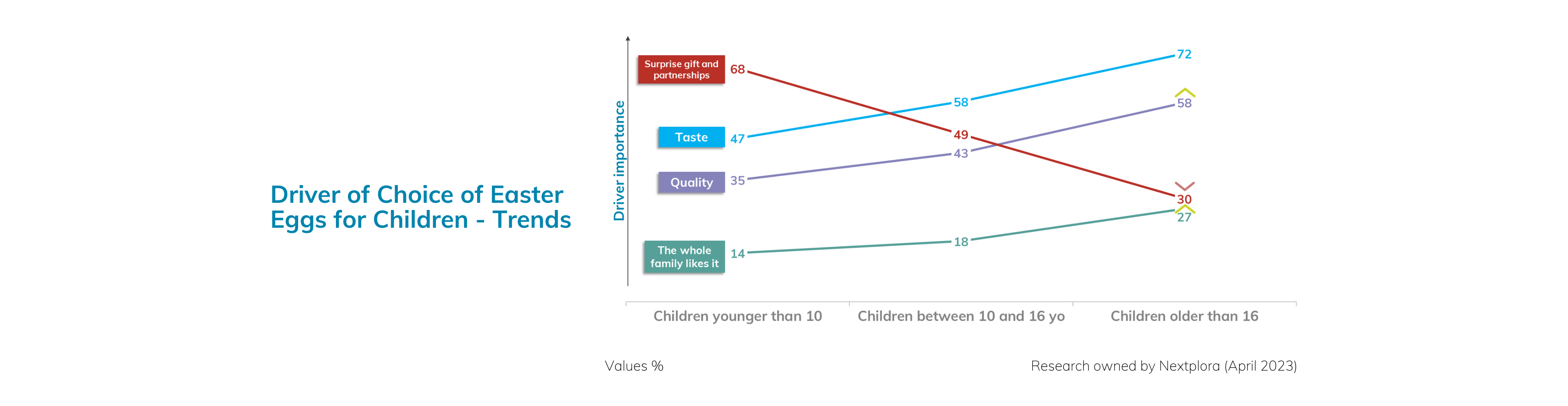

In the third and final graph, we explored how the drivers of choice varied based on the age of children in the household. We found that taste and chocolate quality became increasingly important as children grew older, while the surprise gift and partnerships became less relevant. As children enter their late teens, their taste preferences begin to converge with those of their parents, leading to greater shared enjoyment of Easter eggs within the family.

Italian consumers have distinct and diverse preferences when it comes to buying and consuming Easter eggs, with taste and “Italianness” emerging as the most significant drivers of choice across different segments. The research highlights the importance of understanding the unique needs and priorities of different consumer segments, including those with children and those without, as well as those with a passion for cooking or a focus on sustainability. Brands that can cater to these preferences and effectively communicate their value proposition are likely to succeed in the competitive Easter egg market. However, it’s important to note that consumer behavior and preferences can be fluid and influenced by a variety of factors, including economic conditions, cultural shifts, and emerging trends. As such, ongoing research and adaptation are necessary to stay ahead of the curve and meet changing consumer needs.