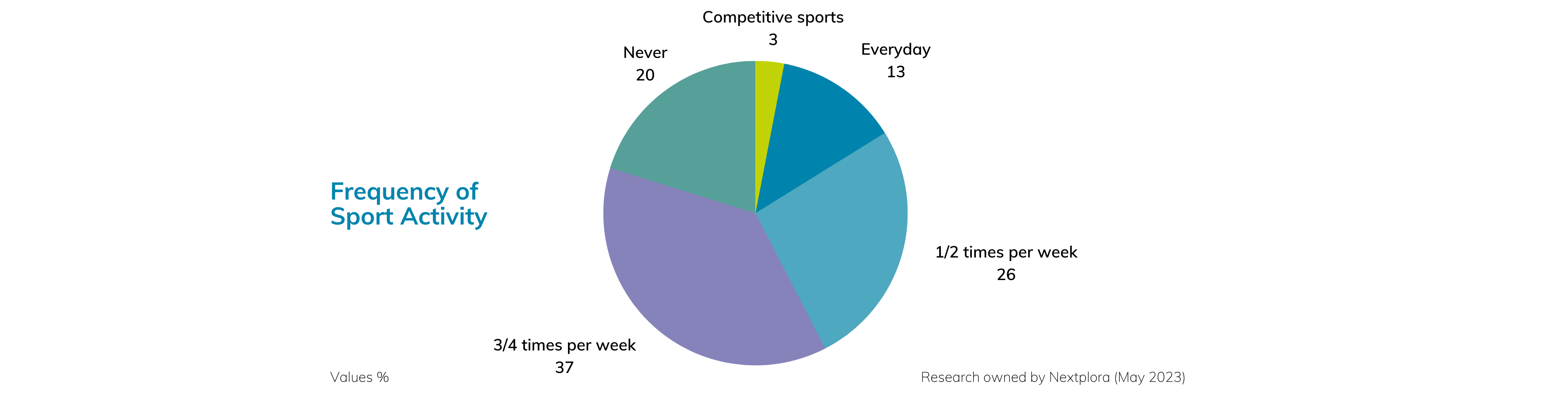

Ready-to-eat high protein foods have witnessed a remarkable surge in popularity, as both active individuals and those focused on maintaining a healthy lifestyle seek convenient and protein-rich options. Notably, brands not originally associated with sports have recognized this growing trend and diversified their product portfolios, aiming to capture the attention of active consumers who prioritize protein intake while seeking enjoyable and convenient options. This article explores the purchase drivers associated with ready-to-eat high protein foods and examines how these drivers differ based on respondents‘ levels of physical activity and their motivations for engaging in sports.

Brand Awareness and Usership

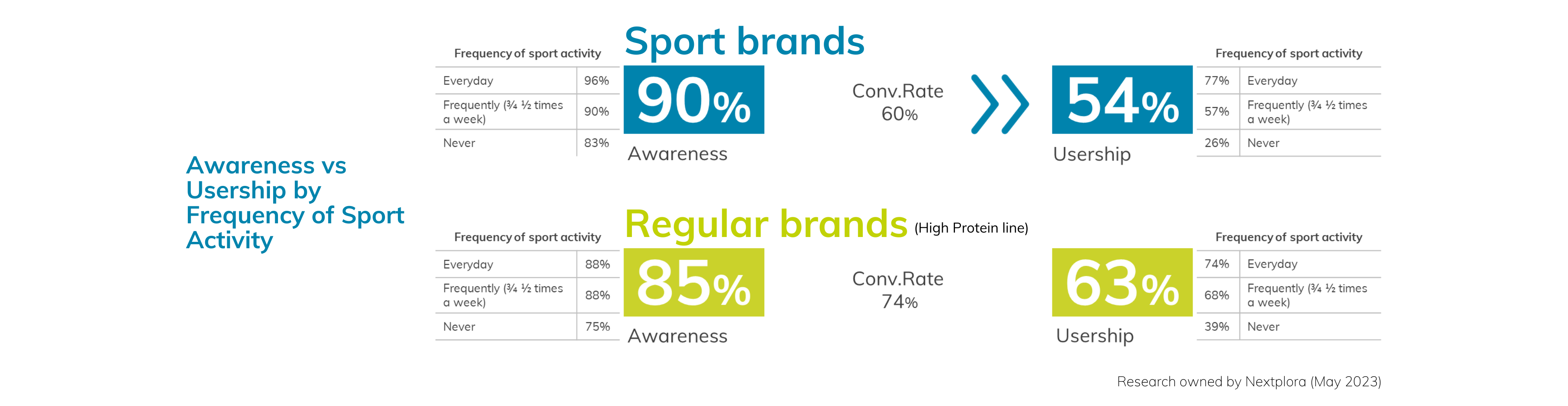

Overall, classic brands have a 14 percent higher conversion rate from awareness to usership than sport brands, although awareness is slightly higher for the latter. This suggests that although sport brands are well known, when it comes to product purchase classic brands with their high protein product lines are better able to translate awareness into actual product adoption.

However, when considering individuals who do not participate in any sport, regular brands exhibit a higher conversion rate than sport brands (52%). This disparity can be attributed to a few key factors. Firstly, sport brands often command a higher price point due to their specialized positioning and targeted marketing efforts. Non-sporty consumers may find these prices less appealing or perceive them as a premium they are unwilling to pay. Additionally, sport brands tend to have limited availability, often being primarily found in specialized stores rather than widely accessible in supermarkets. This limited availability may deter non-sporty individuals from purchasing sport brand products, as they prefer the convenience and familiarity of regular brands that can be found in mainstream retail locations.

Interestingly, among individuals who engage in daily sports activities, sport brands enjoy higher levels of awareness (96%) compared to the sport lines of regular brands (88%), although it remains outstandingly high. This finding suggests that sport brands have effectively cultivated a strong presence and reputation within the active community. However, despite the higher awareness, the sport lines of regular brands are favored by the average sporty individual when it comes to purchase.

Purchase Drivers by Frequency of Sport Activity

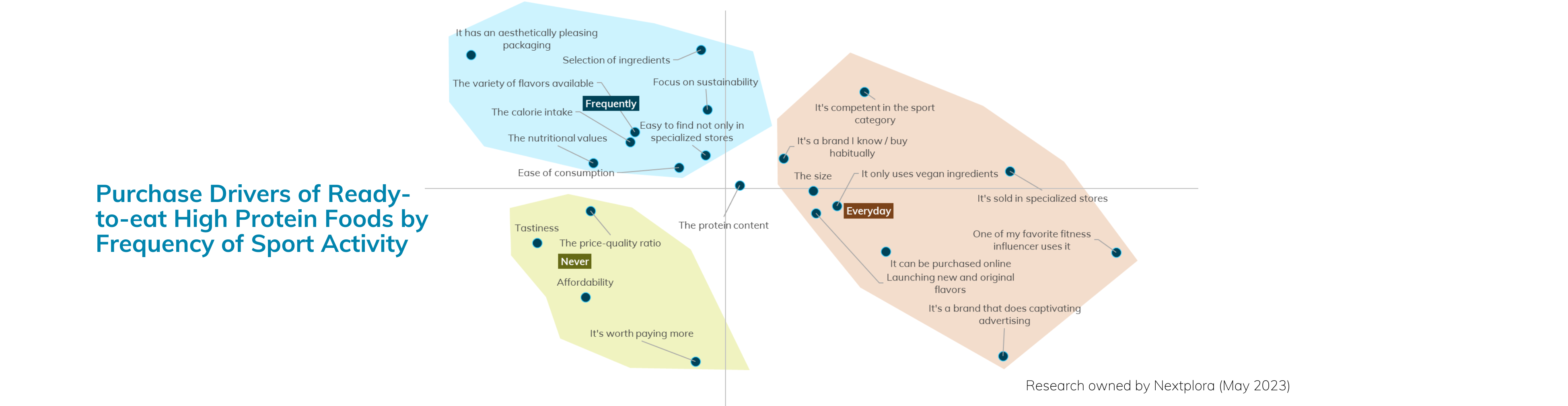

Categorizing respondents into three clusters based on their activity levels (Never, Frequently, Everyday), we identified distinct purchase drivers for each group.

Individuals who do not engage in sports prioritize affordability, tastiness, and price-quality ratio when selecting ready-to-eat high protein foods. This can be attributed to their cost-consciousness, seeking affordable options that fit within their budget, while also prioritizing taste and enjoyment of their meals. They value products that provide a balance between reasonable pricing and perceived quality. Additionally, convenience and ease of incorporation into their daily routine play a crucial role, as they prioritize ready-to-eat options that require minimal preparation and seamlessly fit into their existing meals or snacks.

Those who frequently participate in sports value variety of flavors, calorie intake, sustainability, and the convenience of finding these products in supermarkets rather than specialized stores. Collectively, these preferences reflect the specific needs and priorities of individuals participating in sports frequently, focusing on optimizing their nutrition, maintaining taste satisfaction, and making sustainable choices while prioritizing convenience in their busy lives.

Individuals engaged in daily sports activities prioritize ready-to-eat high protein foods based on specific factors. They highly prioritize the use of vegan ingredients. Originality of flavors is important to maintain variety and enjoyment in their diet. Availability in specialized stores is preferred as these stores cater to their specific dietary needs. Additionally, they prioritize product size for portion control and convenience during their active lifestyles. These preferences reflect their commitment to optimal nutrition, supporting their physical performance, and aligning their dietary choices with their active routines.

Purchase Drivers by Reasons to Do Sport

Cross-referencing the purchase drivers with our proprietary profiling based on respondents’ motivations for engaging in sports, we made intriguing observations:

- ABILITY: Individuals focused on improving their skills and abilities highly value protein content but exhibit neutrality towards ease of consumption and tastiness. Factors such as availability, calories, and affordability are of less importance to this segment.

- COMPETITION AND AWARDS: Ease of consumption is of paramount importance to this segment, while calorie intake holds lesser significance. Protein content and taste are relatively lower on their priority list.

- FITNESS & ANTI-STRESS: Nutritional values, including protein content and calorie considerations, greatly influence this segment’s purchase decisions. Taste, ease of consumption, and availability also play key roles in their choices.

- JUST FOR FUN: This segment exhibits a more balanced view on various purchase drivers, with a stronger emphasis on ease of consumption, followed by nutritional values.

The growing popularity of ready-to-eat high protein foods could indeed be seen as a new trend that is gradually replacing the previous focus on “light” and “low-calorie” products. This shift can be attributed to several factors. Firstly, many individuals today are placing greater emphasis on overall health and fitness, recognizing the importance of adequate protein intake for muscle recovery, satiety, and overall well-being. Ready-to-eat high protein foods offer a convenient and accessible solution to meet these protein needs. Secondly, the market has seen an influx of products that genuinely provide a high protein content relative to their calorie intake, surpassing the average protein levels found in natural foods. Ultimately, the rise of ready-to-eat high protein foods represents a shift in dietary trends towards a focus on protein-rich options, offering consumers a convenient and appealing way to incorporate adequate protein into their daily routines.

Understanding the diverse purchase drivers associated with ready-to-eat high protein foods is crucial for brands seeking to effectively target specific consumer segments. By recognizing the varying needs and preferences of consumers based on their levels of physical activity and motivations for sports engagement, brands can tailor their product offerings and marketing strategies accordingly. For non-sporty individuals, affordability and accessibility are vital considerations, while sporty individuals place greater emphasis on nutritional values, convenience, and sustainability. Moreover, aligning purchase drivers with the underlying motivations for engaging in sports can further enhance brand relevance and consumer appeal. As the market for ready-to-eat high protein foods continues to expand, brands that prioritize consumer insights and adapt their offerings to cater to different target groups will position themselves for success in this competitive landscape.