8 Ways to Maximize the Return on Your Advertising Investment

In the constantly evolving world of advertising, maximizing return on investment is a critical challenge for companies seeking to remain competitive. With the outbreak of new platforms and advertising media, it has become more important than ever to understand how to evaluate, optimize, and adapt advertising strategies to reach desired audiences effectively and efficiently. In this article, we will explore 8 key approaches that can help you overcome challenges and maximize the impact of your advertising campaign. From evaluating metrics to tracking "incremental reach" and from managing ad saturation to real-time planning, we will discover how to address these issues in smart and innovative ways.

1. "How can I evaluate or reconcile the myriad of metrics reported by each medium?”

Every media planner's dream:

Do you have ads in places as diverse as linear TV, Connected TV, YouTube, TikTok or movie theaters? Forget about reconciling fifteen different data sources & audience universes to measure its impact. A unified view of media simplifies everything. You can easily measure the total reach of the campaign, the incidence of each medium in each target and identify the duplicates between them.

Find (and fix) problems:

This approach allows you to effectively maximize your media investment, address pressing challenges such as advertising saturation on certain targets, and gain valuable insights into the optimal frequency needed to positively impact our brand perception or improve online traffic.

2. "There is a 10 percent of my target audience that I can only reach through CTVs."

The "incremental reach" thing is not all that complicated:

In recent years, a new buzzword has burst into the industry: incremental reach. As media consumption becomes more fragmented and some consumer profiles move away from traditional TV, new media must be introduced into the mix to get that incremental reach on top of traditional TV. In recent times, the spotlight has been on Connected TV.

It is as simple as thinking about a fishing area. If you only cast your net in one spot, you will lose fish. It makes sense, but the key is to move from beliefs to numbers.

- How much do these new platforms add to your total reach?

- And what frequency do they offer?

- What percentage see your ads in both mediums?

- How much does it cost you to keep adding coverage points in both mediums?

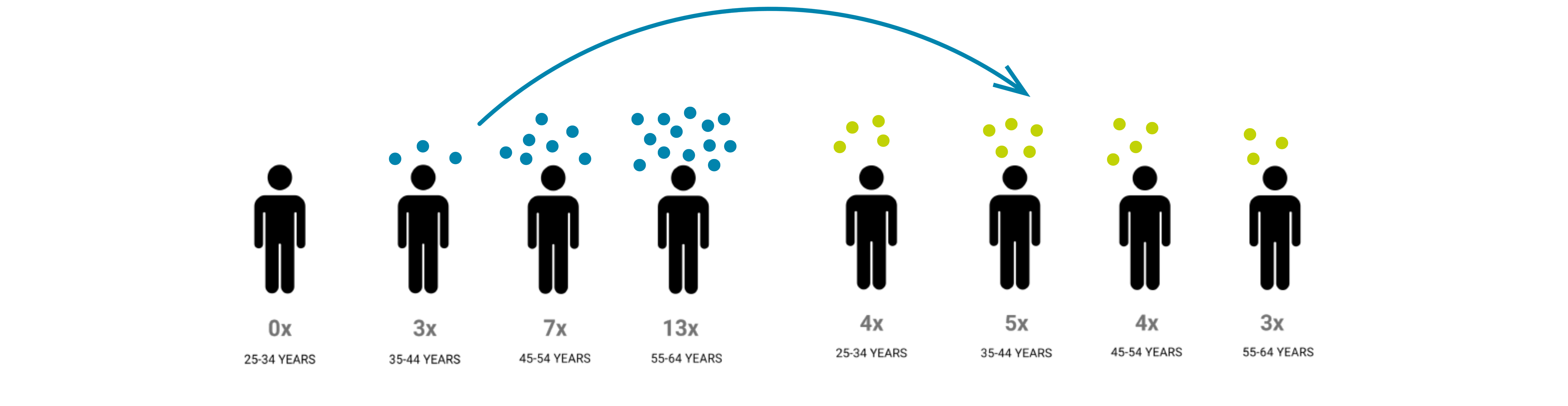

3. "We are burning out a secondary target while the primary target barely saw the ad."

Find out who sees your ads (and who sees them too much or too little) and in what media.

Ad saturation of certain target audiences is one of the big problems in the industry and affects both advertiser budgets and brand health. Its onset has much to do with poor adaptation to the fragmentation of media consumption. Following the previous example, it is as if advertisers are determined to double their efforts in a single fishing ground instead of diversifying. The most common fish in a certain spot -- such as High TV viewers -- will be "caught" several times, while others are unlikely to see the hook... With a unified media view, it will be possible to access the average frequency with which the campaign was viewed, but also by target and medium.

4. "Thanks to the investment optimizations, I was able to keep the campaign going for another week!"

Post-mortem analysis of the campaign is outdated. Make decisions while the campaign is still on the air.

Reports from traditional measurement sources arrive weeks after the campaign has ended. This limits the ability to make meaningful decisions and can reduce measurement to a simple "tick box" activity. Find out what is happening with your cross-media campaign through regularly updated reports and make on-the-fly decisions about your plan to optimize your budget.

Why do we have this information?

Because we do not depend on other sources or data fusion and we scientifically measure what is happening 24/7.

5. "I can finally measure exposure to advertising in social moments, such as watching live sports with friends."

A people meter that goes everywhere with the consumer

If you run advertisements in highly social content, such as live sports or major events, that are frequently watched at friends' or family members' homes or in public places such as bars, traditional measurement is insufficient. With an audiometer that scans the audiovisual context of the panelist wherever he or she goes with the highest accuracy and without affecting the device, the problem disappears. We get a measurement adapted to today's audiovisual consumption: device-agnostic and less anchored to specific moments, but rather dispersed and anarchic in terms of devices, moments or content categories.

Why do we have this information?

Because we made a mobile audiometer from a person's most powerful "body extension": his or her smartphone.

6. "I'm considering Twitch in my strategy, but I'd like to know how it fits into my campaign as a whole"

All the guarantees when you test a new medium.

Twitch, Netflix, TikTok, Retail Media, Podcasts, influencers or branded content of any kind... For some time now, advertising has been constantly changing. The list of platforms or formats on which you can advertise is endless and growing by the day. With Media+Brand Effect you can safely integrate them into your media mix. You can compare their reach with that of your TV or radio ads, figure out who sees them and how often, find out if they allow you to reach new audiences, etc.

7. "I found that my competitors reach Gen-Z better than I do.... How do they do it?"

How effectively do you reach your target audience?

Compare your competitors' reach on each profile with your own. Use demographic data (age, gender or region) and cross-reference it with hyperprofiling data (their socio-economic level, what financial products they have taken out and with which institution, whether they are customers of your brand or your competitors, what car they drive... and more) to get a surprising picture of the target audience you and your competitors are reaching.

How do your competitors split Linear and Digital?

And next, move on to the how... Like you, your competitors face the challenge of allocating their budget into a media plan that covers all targets.

- Find out which media and platforms they have included in their mix;

- Identify opportunities on less explored platforms;

- Find out the effectiveness of some influencers or streamers working with your competitors;

- Clarify doubts about whether or not they are present on some new platforms through their experience.

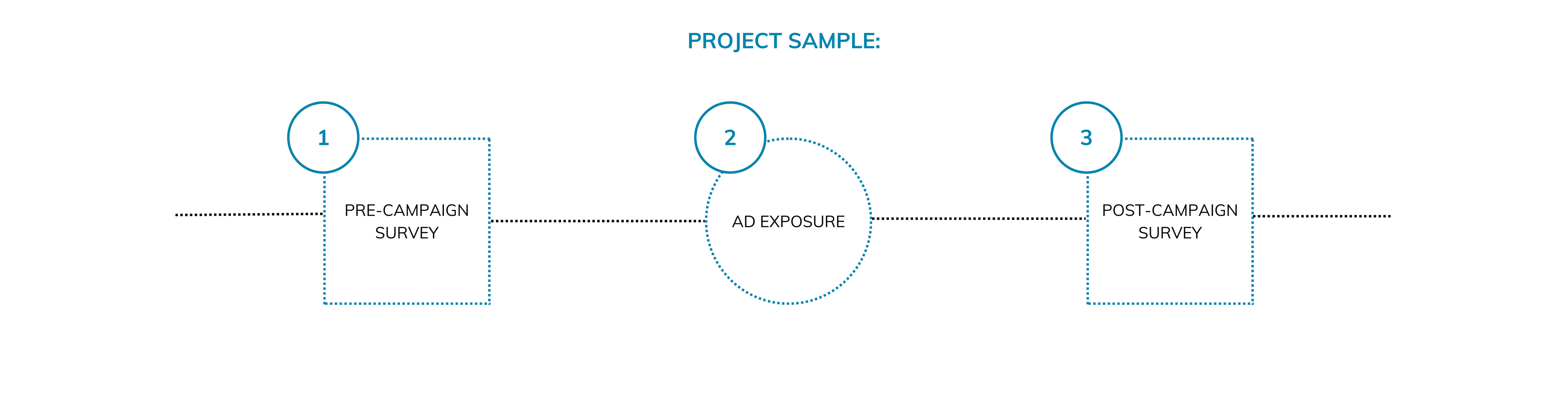

8. "Wow! Women in their 18s and 30s remember our ads better when they see them on YouTube than on TV!"

Stick with the communication and medium (or platform) that gives you the best results.

Post-tests are an established tool in the advertising world. By combining all the information about campaign exposure with the fieldwork, you will be able to determine which media generate a higher recall, what frequency is needed for your campaign to be remembered, or the difference in consideration of your brand between those exposed and those not exposed.

You may be wondering how you can put this into practice. Media+Brand Effect is the only solution that can give you these answers.

- Single source for all media:

Media+Brand Effect measures all media from a single source. This allows them all to speak the same language! This solves the current problems of measuring who-and how many times-a cross-media campaign is being viewed. - Observational measurement:

Its audio-based ACR technology allows us to go beyond declarative sources or traditional audiometers. We examine the individual's audio-visual context and exposure to any audio-visual medium. - On the same people:

Our technology is embedded in the smartphones of a permanent sample population of individuals, so all our data are obtained on the same group. This allows us to obtain a view of the entire population. In addition, exposure data can be enriched with additional layers of data, such as surveys and more.

In an increasingly complex and competitive advertising landscape, the art of maximizing return on investment is critical to the success of any campaign. We examined eight distinct ways to meet this challenge with intelligence and ingenuity, paving the way for more targeted and effective advertising. From finding new reach opportunities to real-time optimization, these approaches offer companies the ability to stay abreast of the changing needs of their audiences. The key to a successful advertising campaign lies in constantly adapting and embracing new strategies. Whether you are trying to reach a specific audience or outperform your competitors, these tactics can help you get the most out of your advertising investments and ensure that your brand remains at the center of your target audience's attention.

September Resolutions: Unveiling Aspirations for a Fresh Start

The start of September brings with it a unique sense of renewal for many Italians, akin to the rejuvenation felt at the beginning of a new year. After the blissful respite of summer holidays, Italians are ready to set their sights on new goals and resolutions. To better understand this phenomenon, we conducted a comprehensive study, delving into the aspirations of Italians for the months and year ahead. In this article, we present our findings, shedding light on the most popular resolutions, the strategies Italians plan to adopt, and even the brands that inspire them.

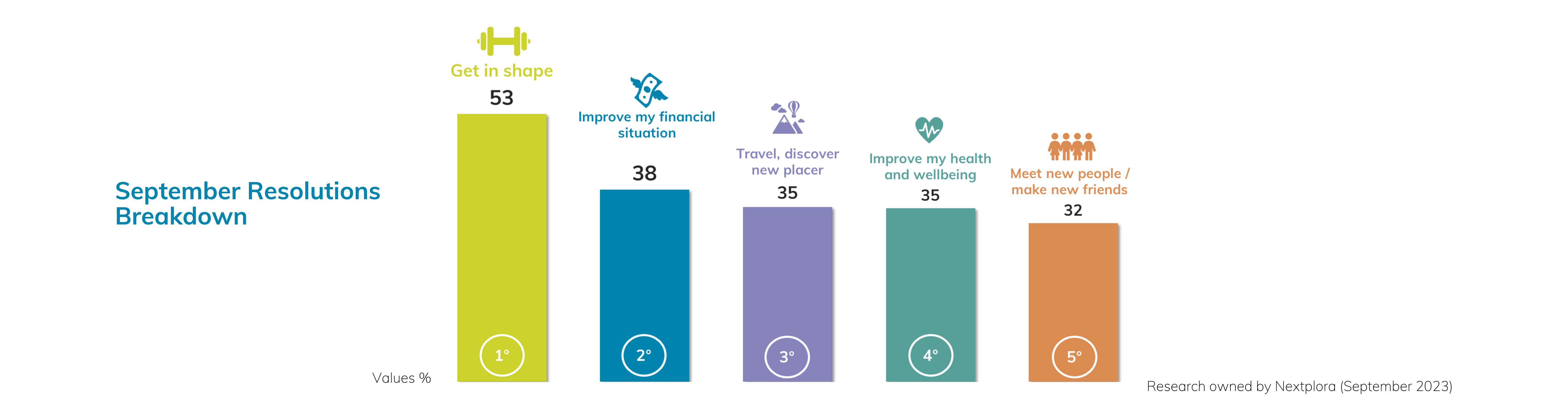

The September Resolutions

Our research reveals that Italians are eager to make positive changes in various aspects of their lives. The top five resolutions include:

- Getting in Shape (53%): A commitment to fitness and well-being.

- Improving Financial Situation (38%): A quest for financial stability.

- Traveling and Discovering New Places (35%): A desire for exploration.

- Improving Health and Well-being (35%): Prioritizing mental and physical health.

- Meeting New People and Making New Friends (32%): A pursuit of social connections.

Getting in Shape

The most popular resolution among Italians is "Getting in Shape." A staggering 53% of respondents expressed their commitment to this goal. However, when we examined how they intend to achieve this objective, some interesting trends emerged.

- Outdoor Activities (62%): Most Italians plan to start with outdoor activities like walking, running, and cycling.

- Improving Eating Habits (60%): A majority also emphasized improving their food choices and habits.

- Starting a Diet (43%): While a substantial number expressed their intent to adopt a proper diet, it was still a less popular choice compared to the Top2.

- Gym Membership (27%): Fewer individuals were willing to commit to joining a gym.

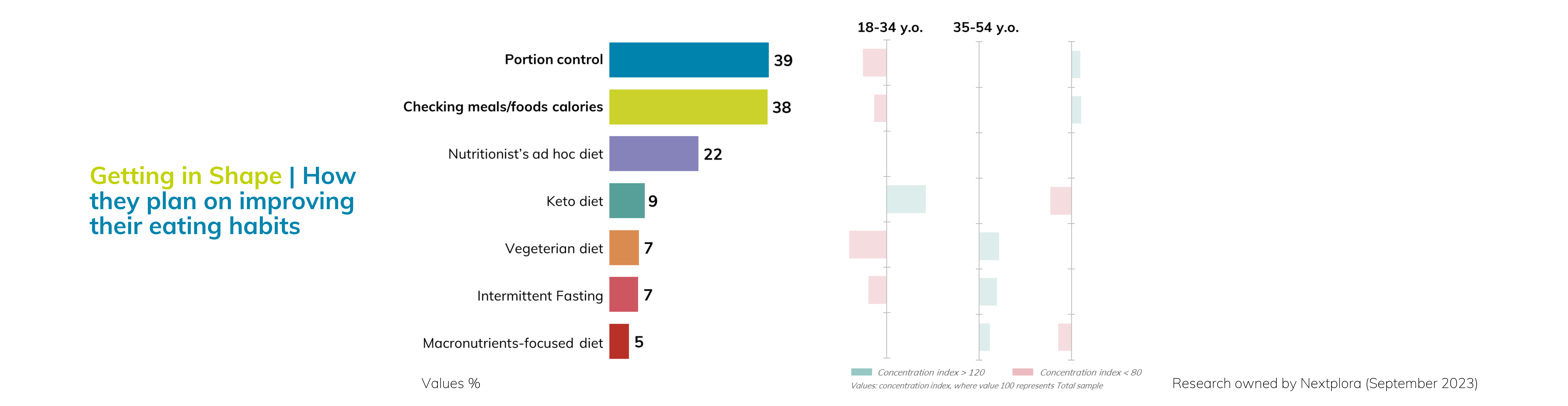

Taking a closer look at dietary preferences by age groups, we found intriguing variations:

- 18-34 y/o: This younger age group leaned towards the Keto diet and were less inclined towards vegetarianism, portion control, and intermittent fasting.

- 35-54 y/o: They exhibited a more favorable attitude towards vegetarianism, intermittent fasting, and macro-focused diets.

- Over 55 y/o: The older generation showed a preference for traditional approaches to healthy eating like portion control and calorie intake control.

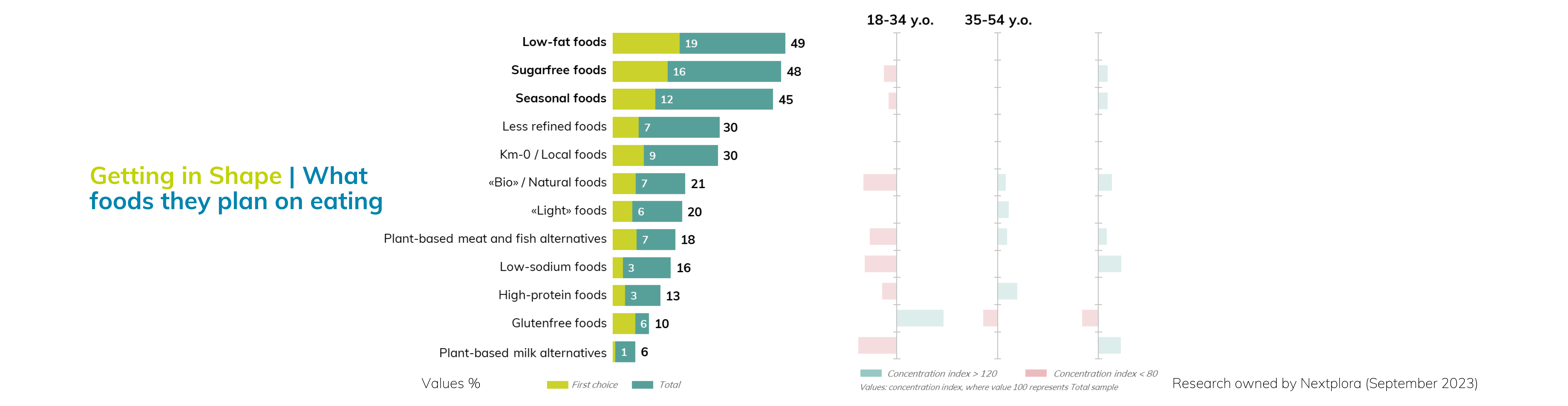

When it comes to prioritizing specific foods for their fitness journey, Italians had varied preferences:

- Low-fat Foods (49%): A top choice for many Italians.

- Sugar-free Foods (48%): Emphasizing reduced sugar intake.

- Seasonal Foods (45%): Embracing fresh, locally sourced produce.

Remarkably, the younger generation (18-35 y/o) showed a preference for gluten-free foods, while those aged 35-54 preferred high-protein foods, "light" options, plant-based alternatives, and "bio" products. The over 55 group leaned towards low-sodium options, plant-based milk alternatives, and "bio" foods.

Lastly, we explored the brands Italians associate with their goal of getting in shape, with results visualized in the accompanying graph.

Improving My Financial Situation

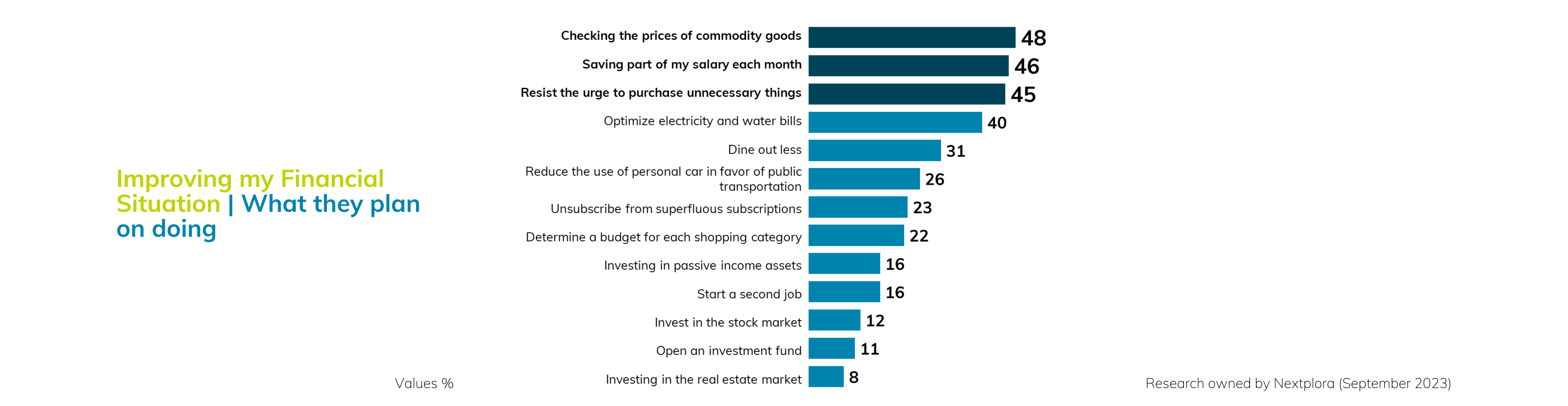

The second most common resolution among Italians is "Improving My Financial Situation," with 38% of respondents committed to this objective. We delved deep into their strategies to achieve this goal:

- Careful Spending (48%): Italians plan to scrutinize commodity prices to save.

- Monthly Savings (46%): Nearly half intend to save a portion of their salary each month.

- Resisting Impulse Buying (45%): Curbing unnecessary spending.

- Optimizing Bills (40%): This includes efforts to reduce electricity and water bills.

- Eating Out Less (31%): While significant, fewer Italians intend to dine out less.

- Using Public Transport (26%): A smaller percentage plan to use public transport, despite rising fuel costs.

Similar to the fitness resolution, we also investigated the brands Italians associate with their aspirations for financial stability, with results presented in a graph below.

In September, Italians embark on a journey of self-improvement and renewal, with aspirations ranging from health and fitness to financial stability. Our research reveals not only the most popular resolutions but also the strategies Italians plan to adopt to achieve them. As we navigate these resolutions, it's evident that Italians are embracing a diverse range of approaches, reflecting their unique preferences and priorities. The associations with specific brands also provide valuable insights into the role of branding in shaping personal goals. As September already comes to an end, it is clear that Italians are seizing the opportunity for a fresh start, setting the stage for a year of positive change and growth.

The Evolution of Product Placement: Traditional Advertising vs. Native Integration

The marriage of entertainment and advertising has a storied history, with product placement acting as the connective tissue between these two realms. However, this avenue of promotion has transformed substantially, setting traditional advertising apart from the contemporary trend of native integration within movies and TV shows. This evolution mirrors shifting consumer behaviors and the pursuit of more genuine, less intrusive advertising techniques. In this article, we will delve into the effectiveness of both these approaches and shed light on the changing terrain of brand partnerships in the captivating world of entertainment.

Traditional Advertising: A Familiar Model

Traditional advertising within movies and TV shows, as we've known it, is characterized by overt displays of brands. You've seen characters sip specific soft drinks, expertly wield a particular smartphone, or cruise in a prominently featured car.

Effectiveness of Traditional Advertising:

- Viewer Awareness: Traditional advertising in movies and TV shows excels at grabbing viewer attention. A study by PQ Media in 2021 reported that branded entertainment, including product placements, reached a staggering 95% of U.S. adults aged 18-49.

- Brand Recall: These placements are memorable, often leading to high brand recall. Research conducted by a leading marketing association found that brand recall from product placements can reach as high as 81%.

- Familiarity and Trust: Traditional placements build familiarity and trust with the brand, especially when seamlessly woven into the storyline. The American Marketing Association notes that product placements often generate positive brand sentiment.

Native Integration: A Subtle Shift

In stark contrast, native integration takes a more subtle approach, seeking to organically integrate brands into the narrative. Instead of a conspicuous display, the focus is on creating an unbroken connection between the brand and the unfolding story.

Effectiveness of Native Integration:

- Enhanced Engagement: Native integration excels in capturing and maintaining viewer engagement. A study conducted by the Interactive Advertising Bureau (IAB) reported that native ads achieve, on average, a 20% higher engagement rate compared to traditional banner ads.

- Increased Purchase Intent: Native integration often leads to a higher intent to purchase. Studies reveal that integrated advertising formats, including native integration, tend to yield a 9% higher purchase intent than traditional ads.

- Authenticity and Viewer Acceptance: Native integration, frequently perceived as less intrusive, tends to be viewed as more authentic by the audience. A survey conducted in the UK market by BENlabs found that 88% of respondents reported "positive emotions" after seeing brands in TV shows, with 60% saying they have searched for a product they've seen on TV.

Changing Landscape of Brand Partnerships

The landscape of brand partnerships in entertainment is undergoing a profound transformation to meet the expectations of today's consumers. Brands are increasingly recognizing the importance of subtlety and authenticity in their advertising endeavors.

- Diversification of Strategies: Brands are diversifying their strategies, often combining traditional placements with native integration to access a broader audience.

- Digital Integration: With the surge of streaming platforms and digital content, brands are venturing into new territories such as interactive ads and e-commerce tie-ins.

- Measuring ROI: Brands are heavily investing in advanced analytics to measure the return on investment (ROI) of their entertainment partnerships, ensuring their advertising spend translates into tangible results.

Influence of Recent Blockbusters: A Barbie Case Study

Recent blockbusters like the Barbie movie have brought the influence of product placement to the forefront. These films not only serve as substantial advertisements for their respective brands but also feature various products seamlessly integrated into their storylines. This underscores the growing willingness of brands to collaborate with the entertainment industry, blurring the lines between content and advertising.

In this movie, viewers may have noticed prominent appearances by brands like Chevrolet, Chanel, TAG Heuer, and more. Chevrolet's spotless 4x4 takes a starring role, while the camera lovingly lingers on Barbie's empowering heart-shaped Chanel bag. Even Ryan Gosling, portraying Ken, sports not one but three TAG Heuer watches in a single scene. These instances illustrate how the film incorporates various products into its storyline seamlessly.

This has sparked conversations about the impact of product placement on audiences and brands. Auto Trader reported a substantial 120% increase in interest for Chevy Corvettes after the release of the Barbie movie trailer. TAG Heuer's CEO claimed that one of its watch models has been affectionately nicknamed the "Barbie watch" by customers.

As of June 2022, the global product placement industry has burgeoned into a $23 billion behemoth, marking a 14% growth in just two years. This growth underscores the eagerness of companies to be featured within movies and TV shows, especially in an era of skippable ads. Yet, it's often challenging to discern whether brands have indeed paid or provided free products for promotion in a film.

Following the remarkable success of movies like Barbie, it's likely that more product-centric films will hit the screens. However, there's an intriguing question on the horizon: will consumer enthusiasm for these nostalgic features endure, or might it eventually give way to fatigue?

Notwithstanding, the streaming universe is witnessing tech giants like Amazon and Apple entering the content creation arena. These platforms are producing their own shows, complete with strategically placed products. The question here is how viewers will perceive this approach. Will it be seen as a cynical intrusion into their content, or is it a novel way to seamlessly connect content with consumption?